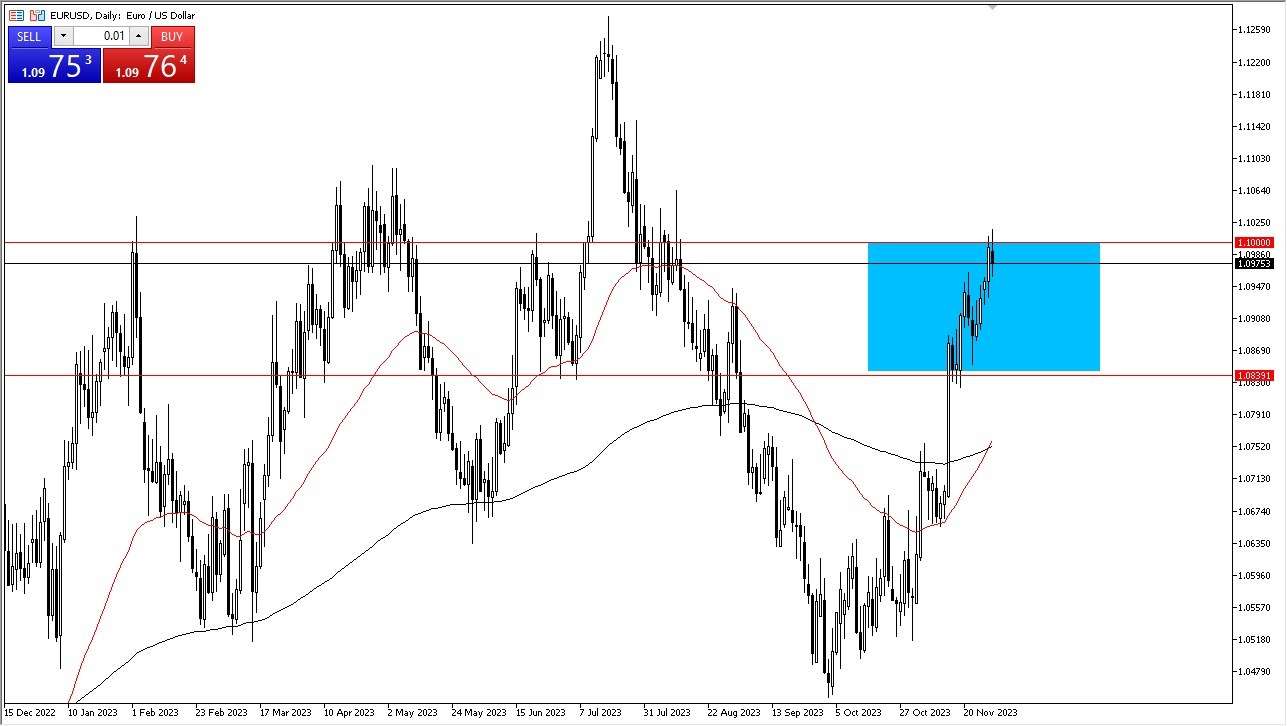

- The EUR/USD embarked on a choppy move during Wednesday's trading session, grappling with the formidable 1.10 level overhead.

- This level, a significant psychological milestone, presented its own set of challenges, adding to the market's noise.

- Should the market breach the lower boundary of Tuesday's candlestick, it might usher in a corrective phase, given its proximity to the 61.8% Fibonacci level, which wields its own influence and could get Dollar bulls excited.

It's important to recognize that the market currently finds itself in an overbought state. However, this shouldn't be misconstrued as the harbinger of an impending collapse. The Federal Reserve is poised to maintain a moderately tight monetary policy, resulting in sustained elevated interest rates, defying some earlier expectations of a more aggressive tightening stance. Recent market behavior suggests an attempt to reevaluate the Federal Reserve's unwavering commitment to tightening policy, as if market players don’t believe them.

An Upward Reversal?

Conversely, an upside reversal, characterized by a breach above the session's Wednesday candlestick high, would paint a decidedly bullish picture. Such a development could pave the way for the euro to rally towards the 1.1250 level. Nonetheless, it's crucial to acknowledge that the market has been operating in an extended state for some time, with a growing awareness of the force of gravity exerting its influence. Beneath the surface, the 1.0850 level stands as a credible support zone, as it has demonstrated its resilience in the past.

All things considered, this market must burn off some of its excess enthusiasm, and while a dip in the euro's value may be likely, a significant selloff is not imminent. To spark a substantial shift in sentiment and direction, the market would require a compelling fundamental catalyst to shift its prevailing attitude towards a more sustained negative trend.

Ultimately, the euro's recent trajectory has been marked by noise and challenges posed by the 1.10 level. The current overbought condition should be viewed as a sign of caution rather than impending doom. The Federal Reserve's monetary policy and interest rate dynamics continue to be influential factors, and the market's recent fervor is a bit overdone. However, the trend seems to be substantiating its importance and reality. At this point, it looks like we are trying to attract more buyers.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.