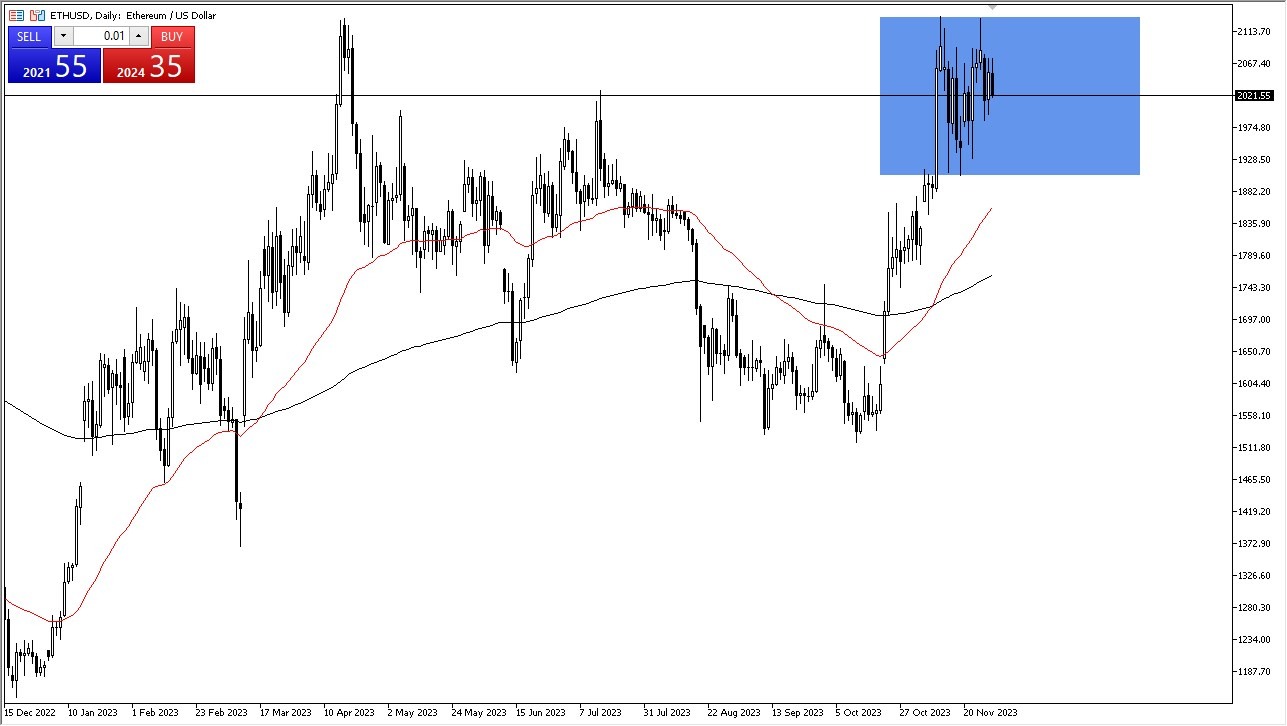

- The Ethereum market has maintained a sense of calm in the early hours of Wednesday trading, as it continues to hang out just above the critical $2000 threshold.

- The significance of this level cannot be understated, as it represents a substantial, round, and psychologically potent figure that has garnered keen attention from market participants.

- In recent weeks, the market has been characterized by heightened volatility, signaling that a period of uncertainty may still be in the cards.

The prevailing dynamics in this market suggest that support can be found all the way down to the $1925 level, while the $2125 level looms overhead, presenting a formidable barrier of resistance. In other words, there is a lot of noise above and below.

Broadly speaking, Ethereum remains ensconced in a realm of pronounced price fluctuations, a phenomenon that can be attributed to the ongoing scrutiny of the bond market. The bond market's performance has a significant bearing on interest rates, which, in turn, exert a profound influence on the cryptocurrency arena. Cryptocurrencies, including Ethereum, tend to fare poorly in environments characterized by tight monetary policy.

Monetary Policy is Crucial

It's worth noting that we have only experienced such a policy once, and it had detrimental consequences for the cryptocurrency market. Thus, if market participants continue to witness a dovish stance on interest rates, it's highly probable that cryptocurrency prices, including Ethereum, will continue to ascend.

In this milieu of uncertainty, it's crucial to acknowledge that the Ethereum market remains entrenched in a state of tumult, demanding a measure of fundamental clarity regarding interest rates to chart a definitive course. Nonetheless, signs point towards the likelihood of ongoing consolidation leading to further price movements. Nevertheless, should Ethereum breach the $1800 level to the downside, it could find itself in a precarious position.

Additionally, vigilant attention must be paid to Bitcoin, as it often serves as a harbinger for the broader cryptocurrency market. If Bitcoin embarks on a rally, Ethereum is likely to follow suit. Conversely, should Bitcoin falter, Ethereum could face a severe downturn.

At the end of the day, Ethereum's journey is one of uncertainty, underscored by its proximity to the pivotal $2000 mark. The interplay between interest rates and cryptocurrency performance remains a significant factor to watch. Ethereum seems poised for further price action, but its ultimate direction hinges on a variety of external factors, including Bitcoin's performance and interest rate trends.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.