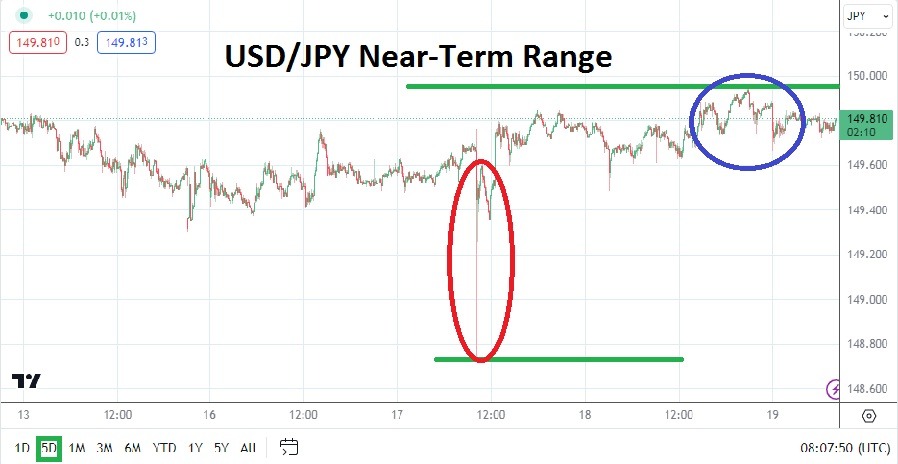

As of this writing the USD/JPY is trading near the 149.825 mark as the currency pair traverses near high water marks, but still remains below the 150.000 level even though it has been within sight since the start of October. Yes, the USD/JPY did trade at the 150.140 ratio momentarily on the 3rd of October, but yesterday’s high around 149.940 could not find the extra dose of buying to drive the currency pair above the key psychological level.

USD/JPY traders and financial institutions are braced for tomorrow’s National Core Consumer Price Index numbers from Japan. There is an expectation the inflation numbers will come in below the previous month’s total. The estimate for Friday’s data is a gain of 2.7%. However, financial institutions are also on alert for the potential of revisions to last month’s figures. If the CPI data produces any surprises volatility in the USD/JPY could be exhibited rapidly.

USD/JPY and Durable Resistance Levels

Traders who are simply trying to take advantage of small movements in the USD/JPY may feel comfortable within the current price range, but they should not. The USD/JPY is capable of delivering price velocity which can wreck trading positions if they are not protected with risk management. As an example, on Tuesday of this week, the USD/JPY suddenly went from about 149.765 to 148.750 in only a few minutes.

Financial institutions remain concerned the Bank of Japan could step in with an intervention and create selling momentum to arise like lightning in the USD/JPY. Open interest positions via the options market at the Chicago Mercantile Exchange in the Japanese Yen remains high, meaning investors have braced for a potential large move in the USD/JPY and are keeping the trades open to protect themselves against violent price fluctuations.

Tomorrow’s CPI numbers from Japan may not get a lot of fanfare leading up to the release of the data, but the results could shake the USD/JPY. The tight range of the currency pair also shows risk-averse conditions globally have created a cautious environment, but at some point this could erode and the USD/JPY could burst into action.

Lack of Clarity for USD/JPY Traders

- Because of recent U.S economic data like Retail Sales figures published earlier this week, it is more than likely the Federal Reserve will increase their interest rate by another quarter of a point, but this has mostly been priced into the USD/JPY already.

- Speculators looking for ambitious price movements in the USD/JPY should practice solid risk management in the coming 24 hours.

USD/JPY Short Term Outlook:

Current Resistance: 149.895

Current Support: 149.690

High Target: 150.090

Low Target: 148.910

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.