Top Forex Brokers

My previous BTC/USD signal on 12th October was not triggered none of the key price levels were reached that day.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades must be taken prior to 5pm Tokyo time Friday.

Long Trade Ideas

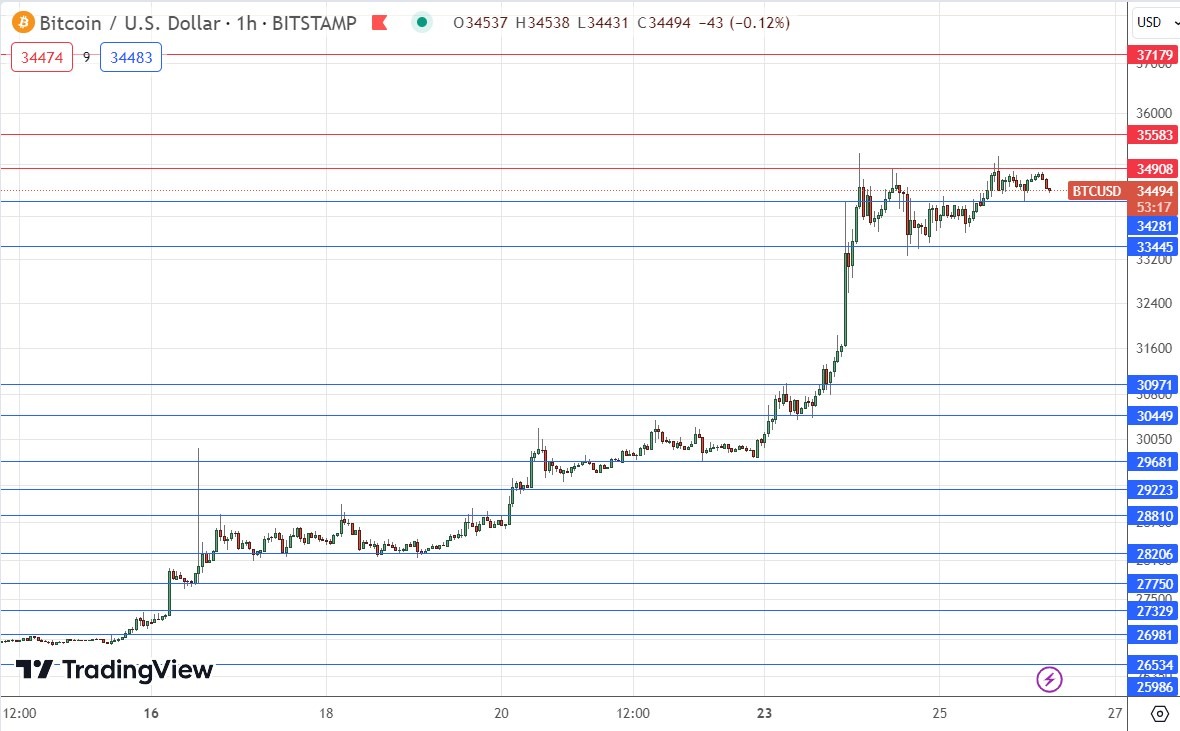

- Long entry after a bullish price action reversal on the H1 timeframe following the next touch of $34,281 or $33,445.

- Place the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry after a bearish price action reversal on the H1 timeframe following the next touch of $34,908, $35,583, or $37,179.

- Place the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote in my previous BTC/USD analysis that there could be a good short trade entry opportunity due to the medium-term bearish trend. In fact, there was little volatility that day, and none of my key levels were reached.

The technical picture has become much more bullish over the past two weeks, especially over the past few days, with the strong, fast rise to the $35k upon rumours that the first Bitcoin ETF was close to gaining approval. This has not become reality yet, but it is enough to keep the price testing the $35k area.

However, bulls are so far failing to break above the $35k level, which looks pivotal, and we have seen a bearish double top chart pattern forming from these rejections.

I think the next thing to watch is whether the support levels at $34,281 or $33,445 continue to hold. Bullish bounces at these levels could be good long trade entries, but if the price gets established below $33,445 it could fall far quite quickly.

As the price has risen strongly to make new multi-month highs, Bitcoin could be very attractive to trend traders on the long side. Conservative traders might want to wait for a bullish daily close above $35k before entering.

Concerning the US Dollar, there will be a release of US Advance GDP data and Unemployment Claims data at 1:30pm London time.

Ready to trade our daily Bitcoin signals? Here’s our list of the best crypto brokers worth reviewing.