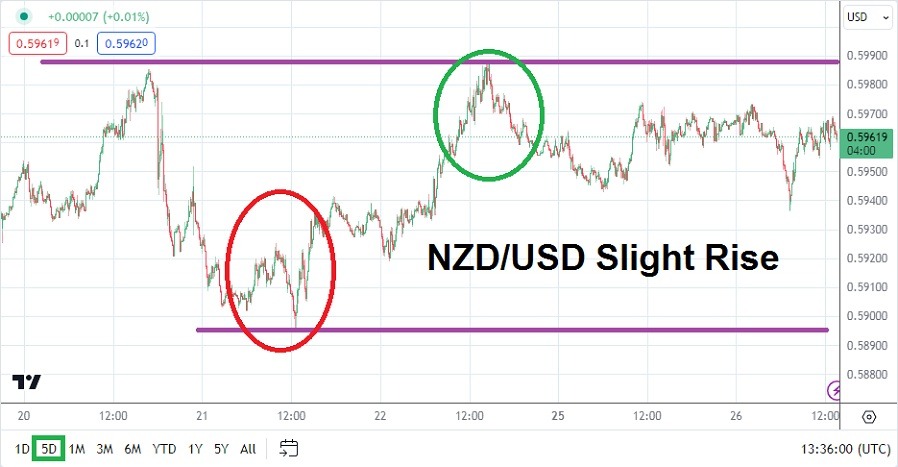

The NZD/USD hit a low of nearly 0.58950 last Thursday as nervous trading took hold in the broad Forex markets and the currency pair correlated to the risk-adverse sentiment being generated. However, since touching the lows on Thursday of last week the NZD/USD has climbed higher. Friday saw an apex price of 0.59890 in the currency pair, this price had last been seen on the 1st of September when the NZD/USD traded briefly above the 0.60000 ratio.

The NZD/USD remains seemingly locked within a known range as it tests ground between 0.59400 and 0.59800. Currently, the NZD/USD has been able to linger within the higher part of its near-term range, but it must be said the currency pair remains within the lower depths of its six-month chart. The price action of the NZD/USD has reflected what other major currency pairs have demonstrated as the USD has been significantly stronger in the past few months of trading.

Persistent Nervous Conditions may remain within the NZD/USD Landscape

The nervous conditions within the NZD/USD are not going to vanish soon. This coming Thursday the U.S. will release its GDP results. The growth numbers which will be published in the early morning in the States will impact Forex and equity markets. The U.S. economy has remained stubbornly strong and this has created tension for the U.S. central bank which would like to see inflation weaken. However, the Fed has made it clear they are likely to hike the Federal Funds Rate in November.

If the U.S economy continues to show signs of strength and actually comes in stronger than anticipated via the Gross Domestic Product numbers on Thursday, this could spark additional buying of the USD globally based on the notion the U.S Federal Reserve will have to remain aggressive and keep interest rates higher than many financial institutions had forecast for the coming six months. Meaning U.S Treasury yields could remain high.

NZD/USD Price Range Likely to Remain Choppy Until U.S GDP Numbers Published

- Until Thursday’s U.S GDP numbers are printed, NZD/USD traders should anticipate nervous choppy conditions as positions are wagered on before the key economic data.

- After the publication of the U.S growth numbers, NZD/USD may be able to create a trend, but full volume for the currency pair will not be established until New Zealand financial institutions open for business again on early Friday, meaning volatility could remain plentiful near-term.

NZD/USD Short Term Outlook:

Current Resistance: 0.59770

Current Support: 0.59350

High Target: 0.60110

Low Target: 0.58890

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.