Top Forex Brokers

Bearish view

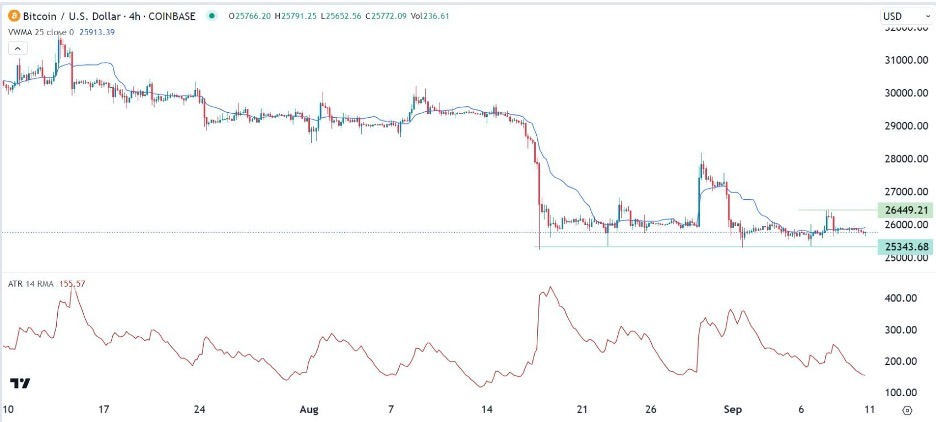

- Sell the BTC/USD pair and set a take-profit at 25,340.

- Add a stop-loss at 26,450.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 25,980 and a take-profit at 27,000.

- Add a stop-loss at 24,300.

Bitcoin price was flat on Monday morning, continuing a trend that has been going on for the past few weeks. The BTC/USD pair was consolidating at 25,732, where it has been stuck at in the past few days. This price is much lower than the year-to-date high of over $31,000.

Waiting for the next catalyst

Bitcoin and other cryptocurrencies have been flat recently as investors wait for the next catalyst. The recent important news have not moved them as most analysts were expecting.

For example, Bitcoin initially soared to $28,000 after Grayscale won a landmark case against the Securities and Exchange Commission (SEC). In that case, the court forced the SEC to review Grayscale’s decision to convert GBTC into an ETF.

The BTC/USD pair has also moved sideways as investors react to the rising crude oil and US dollar index. Brent and WTI rose to $90 and $87, respectively. The implication is that inflation in the US and other countries could have sticky inflation for a while.

This explains why the US dollar index (DXY) has jumped to $105, much higher than the year-to-date low of $99.5.

The next important news that could move the BTC/USD pair will be the upcoming US consumer inflation data scheduled for Wednesday. Economists polled by Reuters expect the data to show that the headline CPI rose from 3.2% in July to 3.4% in June. They believe that the core CPI dropped to 4.2% during the month.

Inflation matters for Bitcoin and other cryptocurrencies because of the impact on the Federal Reserve. Higher inflation figures could put pressure on the bank to hike interest rates in the upcoming meeting.

BTC/USD technical analysis

The 4H chart shows that the BTC/USD pair has been stuck in a range in the past few days. In this period, it has remained slightly above the key support level at 25,343, the lowest levels since August. As a result, it is consolidating at the 25-period moving average while the Average True Range (ATR) has drifted downwards.

Therefore, the outlook for Bitcoin is neutral, with the consolidation set to continue for a while. The key support and resistance levels to watch will be at 25,345 and 26,450, respectively.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.