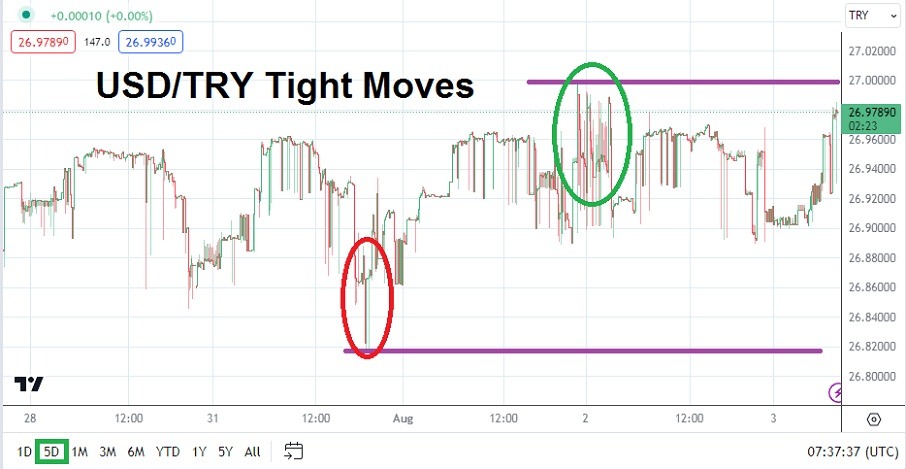

The USD/TRY as of this writing is near the 26.98200 vicinity with rather quick and wide price action taking place as bids and asks are fulfilled via trading houses. Inflation data was brought forth from Turkey this morning and came in slightly above the anticipated number. A result of 9.49% was the outcome for the month. This is still a high rate of inflation, and some of the upwards price movement likely occurred because in late May and the first few weeks in June of this year election jitters in Turkey caused the Turkish Lira to lose value significantly, which sparked higher consumer prices domestically.

However, the USD/TRY has produced a rather solid trading landscape in the past two weeks. On the 13th of July, the USD/TRY was trading near 26.1110. On the 17th of July, the USD/TRY was trading near 26.18000 as some upwards momentum built. On the 18th of July, the USD/TRY hit a high momentarily around the 27.01000 level. But since then the currency pair’s results have caused traders actually to consider the prevalence of rather choppy price action – up and down.

Inflation Concerns in Turkey and U.S Federal Reserve Shadows

The near-term price action of the USD/TRY should be monitored. Financial institutions have accepted the change of leadership within the Central Bank of the Republic of Turkey rather well in the past month. The consolidated price range produced over the past two and a half weeks has been welcomed. However, today’s inflation outcome from Turkey will certainly make behavioral sentiment nervous. Additionally, the ratings downgrade in the U.S from the Fitch agency to U.S Treasuries has created a momentary shift to risk-averse assets. While it may feel counter-intuitive the USD has gotten stronger the past 24 hours.

USD/TRY Resistance Levels Feel like a Trading Goal but are Still Distant

- Psychologically the 27.00000 level may feel close to USD/TRY bullish traders, but they should not be overly ambitious. Quick-hitting trades for traders that are cautious and use entry points to avoid wide spreads via bids and asks is a solid tactic.

- Tomorrow the U.S. will publish Non-Farm Employment Change and Average Hourly Earnings numbers. A lower wage outcome than the one anticipated could spark some weakness in the USD in the broad Forex markets.

- However, traders of the USD/TRY should be careful and watch the movement of the currency pair closely today, because nervous behavioral sentiment is boiling under the surface. This could mean choppy outcomes.

Turkish Lira Short-Term Outlook:

Current Resistance: 26.98500

Current Support: 26.97950

High Target: 26.99100

Low Target: 26.97500

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.