Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 25.35 level.

- Place a stop loss point to close below the 24.95 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the remaining contracts until the strong resistance level at 27.00.

Best-selling entry points

- Entering a sell order pending order from the 27.00 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 25.70.

The USD/TRY rose during early European trading this morning, Wednesday, slightly, amid reports of holding a meeting of the Economic Coordination Council headed by the Turkish Vice President. No details have been mentioned yet about the decisions of the meeting, as newspapers published that the main objective of that meeting was Anti-inflation. Meanwhile, the lira continued its losses slightly against the dollar, after it rose during the past week by about 7 percent against the dollar, after the Turkish Central Bank's decision to raise interest rates in the country by 750 points, which is a percentage greater than previous market expectations. The main interest rate in the country has reached 25 percent, amid expectations that the country will witness more interest rate hikes so that the new economic team appointed by Turkish President Recep Tayyip Erdogan can control inflation rates. Inflation rose during the month of July, approaching 50 percent, compared to 39 percent recorded in June (taking into account the decline in inflation during June due to the non-accounting of the gas price) in light of the electoral grants that Erdogan launched prior to his election. It is noteworthy that the Central Bank of Turkey records a gradual shift in the country's monetary policy from stimulus policy to monetary tightening to control high inflation.

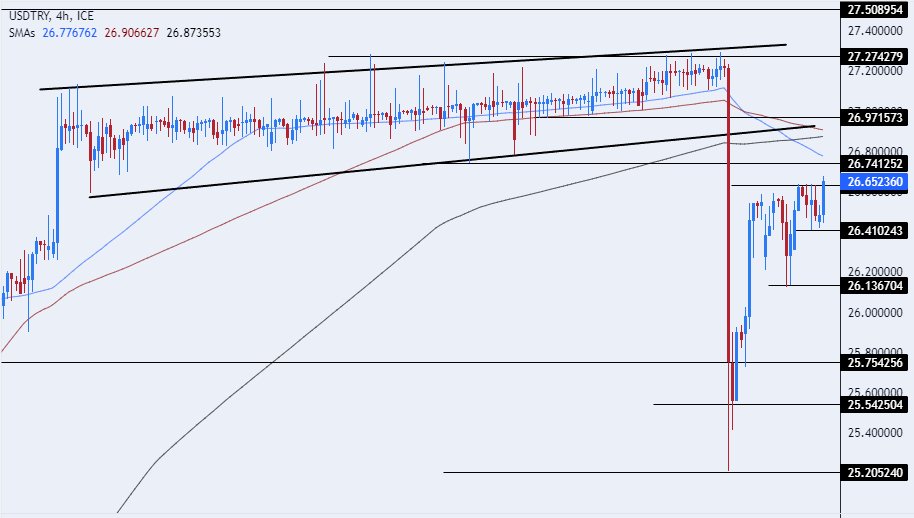

TRY/USD Technical Analysis

On the technical front, the dollar pair traded slightly against the Turkish lira on Wednesday, as the pair is heading to retest the lower border of the bullish channel on the four-hour time frame, which it broke during the racing week, after settling inside it for several weeks. If the pair rises, it will target the resistance levels that are concentrated at 27.00 and 27.50, respectively, while if the pair declines, it will target the support levels that are concentrated at 26.00 and 25.70, respectively.

The price moves above the moving averages 50, 100, and 200 on the time frame of the day, while the pair trades below these averages in the time frame of four hours, at the same time, the pair trades between these same averages on the time frame of the 60 minutes in a sign of the divergence recorded by the pair on the long term short. The pair is expected to record some gains, as it aims to retest the lower boundary of the price channel, which was broken by the price, before resuming the decline. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.