Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 26.50 level.

- Place a stop loss point to close below the 26.25 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 27.50.

Best-selling entry points

- Entering a sell order pending order from the 27.50 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 26.50.

The USD/TRY stabilized, trading near new all-time highs. Investors followed the inflation data released early this morning. The consumer price index rose during the month of July. This occurred after it recorded a decline during the month of June, driven by the government tax increases in the country, the Turkish government sought to control the general budget in the country with the expansion of the volume of spending significantly due to the pledges it made Erdogan's administration in the run-up to the elections last May, in addition to the huge expenditures committed by the Turkish government in the framework of the reconstruction of the areas affected by the earthquake that struck the south of the country last February.

According to data issued by the Turkish Statistical Office, the consumer price index in Turkey increased by 47.8 percent on an annual basis last July, compared to 38.2 percent recorded in June, which exceeds analysts' expectations, which were at levels of 46.8 percent. Hafiza Ghaya Arkan, who holds the position of governor of the Central Bank of Turkey, issued at the end of last week inflation expectations in the country during the current year, which was around the 58 percent level. It is noteworthy that Turkey recorded record levels of inflation in October last year, which reached 85 percent, the highest level in 24 years.

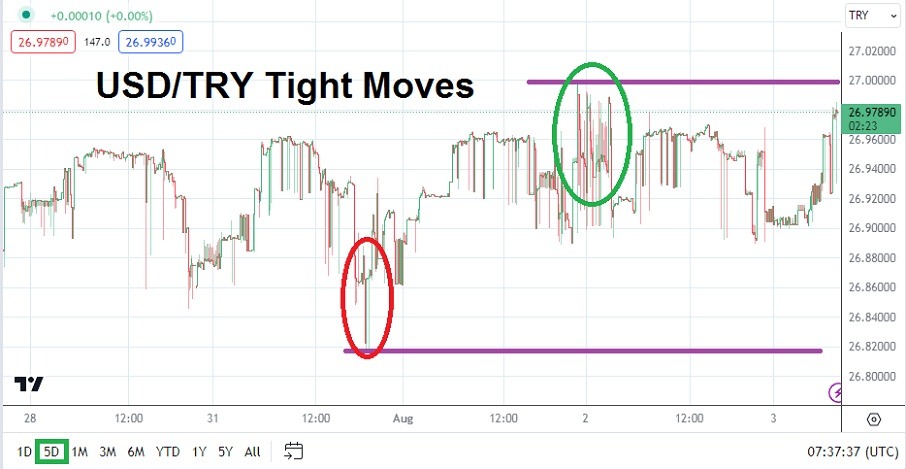

TRY/USD Technical Analysis

On the technical level, the dollar settled against the Turkish lira, near the new peak recorded during the current week, at the level of 27.24 pounds per dollar. The pair returned to trading within a limited range around the integer levels of 27 pounds per dollar. The pair is currently trading within a limited trading range within a general bullish trend. Currently, the price is trading below other resistance areas concentrated between the levels of 27.24 and 27.50, and it is trading above the support levels that are concentrated at 26.50 and 26.00, respectively.

The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. It is expected that the impact of the tightening by the Turkish Central Bank on the price of the lira, which analysts estimated to be around 29 liras per dollar, is expected to be delayed. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.