Bearish view

- Sell the BTC/USD pair and set a take-profit at 28,800.

- Add a stop-loss at 30,000.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 29,500 and a take-profit at 30,500.

- Add a stop-loss at 28,500.

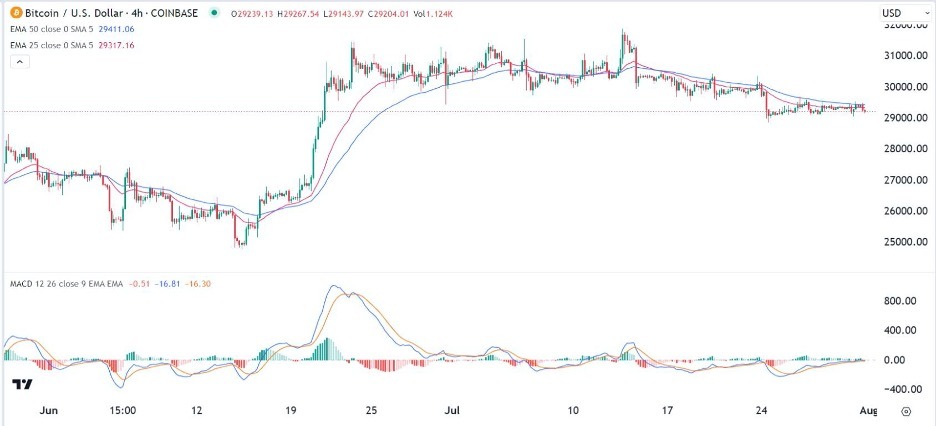

Bitcoin price continued to consolidate this week as investors wait for the next catalyst and as volume in the industry dries up. The BTC/USD pair has been hovering around the support at 29,200, where it has been in the past few days.

Volume and volatility ease

Bitcoin and other cryptocurrencies have been in a tight range in the past few weeks. This consolidation started in the end of June. In this period, cryptocurrencies have reacted mildly to key news in the industry.

For example, the crypto industry prevailed when the outcome of the Ripple vs SEC case concluded in July. The key part of the outcome was that the judge ruled that XRP was not financial security.

Another important catalyst that failed to move cryptocurrency prices was the latest American inflation data. The numbers revealed that the headline consumer price index (CPI) dropped from 4.1% in May to 3.0% in June. In the same period, personal consumption expenditure (PCE) declined to 3.1%. PCE is Fed’s favorite inflation gauge.

At the same time, the Federal Reserve delivered what could be the last rate hike of the season. It hiked rates by 0.25% and pushed them to the highest level in over 20 years. Historically, all these events were positive for cryptocurrencies.

A likely reason why Bitcoin underperformed is that the correlation between crypto and stocks waned during the month. As a result, there is an ongoing rotation from the ‘sleeping’ cryptocurrencies to stocks.

American stocks jumped sharply in July. The Nasdaq 100 and S&P 500 indices jumped to the highest level in months. As a result, some investors likely moved their assets to high-performing equities.

BTC/USD technical analysis

The BTC/USD pair has been in a strong consolidation phase in the past few weeks. It has remained below the important resistance level at 30,000. On the four-hour chart, the pair is consolidating at the 25-period and 50-period moving averages. Bollinger Bands have also narrowed, signaling that there is limited volatility.

The MACD has remained below the neutral level while the Average True Range (ATR) has pointed downwards. Therefore, the BTC/USD pair will likely remain in this range on Tuesday as investors wait for the next catalyst. A bearish breakout will be confirmed if the pair drops below the support at 29,000 in a high-volume environment.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.