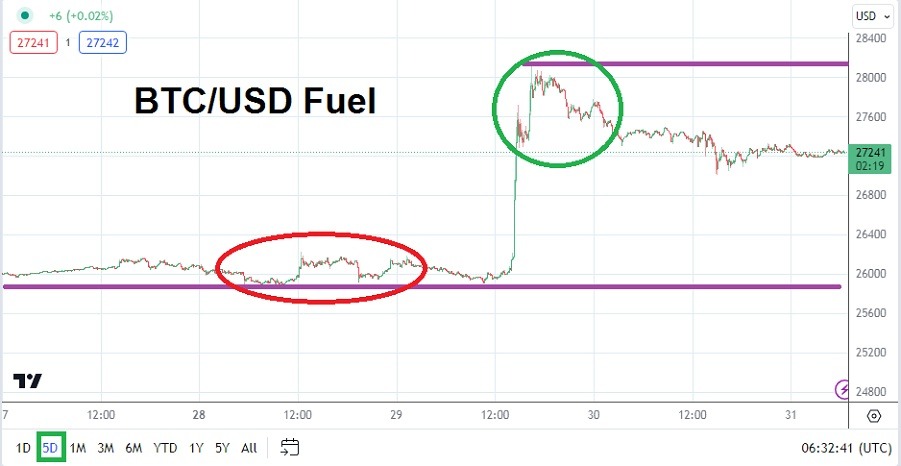

BTC/USD is near 27,250.00 as of this writing. At the beginning of Tuesday’s trading, Bitcoin was around the 26,000.00 mark where it had essentially been traversing the prior few days. What changed? A U.S. Appeals court ruling against the Securities Exchange Commission outlined why the Greyscale Bitcoin Trust proposed ETF should not be allowed to operate. BTC/USD shot up as if given rocket fuel on Tuesday to a high of nearly 28,150.00 on the potential an ETF of Bitcoin is possible in the mid-term.

Speculators will note that the price of BTC/USD has actually traded lower since this injection of fast buying. The price has tumbled almost 900.00 since Tuesday’s highs. While the news of a potential ETF operating in the U.S. could prove to be game-changing for Bitcoin, several legal hurdles and regulatory rules still have to be jumped successfully. And it is not entirely clear that Greyscale or its competitors looking to start an ETF in the States will be granted authority to operate so easily. The last day and a half have seen declines in BTC/USD again.

Lows Seen Before in BTC/USD Remain Worrisome and Resistance is Problematic

Even though Bitcoin was able to jump about 2,000.00 USD within the flick of an eye on Tuesday, it should be noted that BTC/USD remains under interesting resistance levels. The inability to not sustain momentum above the 28,000.00 ratio is rather troubling. And BTC/USD is now hovering above what could be considered dangerously crucial psychological support near 27,000.00.

- Support and resistance levels short-term should be monitored near the 27,100.00 to 27,500.00 levels.

- Traders may be tempted to follow the ‘good news’ of the U.S Appeals Court ruling with buying, but they should also know the impetus higher may have run its path for the time being, and nervous trading may resume which could test support levels.

Trading Volumes Remain Low in Cryptos and in Bitcoin

Tuesday’s surge higher in BTC/USD was certainly welcomed by bullish speculators and influencers who continue to believe Bitcoin is the solution to many financial issues. However, trading volumes in the broad cryptocurrency markets and the digital asset, Bitcoin, actually remain quite low. BTC/USD has not been able to muster a sustained rally higher, Tuesday’s rocket ride upwards must have made some speculators a lot of money, but the move lower the past day and a half is a reminder trading conditions are always challenging.

Bitcoin Short-Term Outlook:

Current Resistance: 27,375.00

Current Support: 27,210.00

High Target: 27,590.00

Low Target: 26,850.00

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.