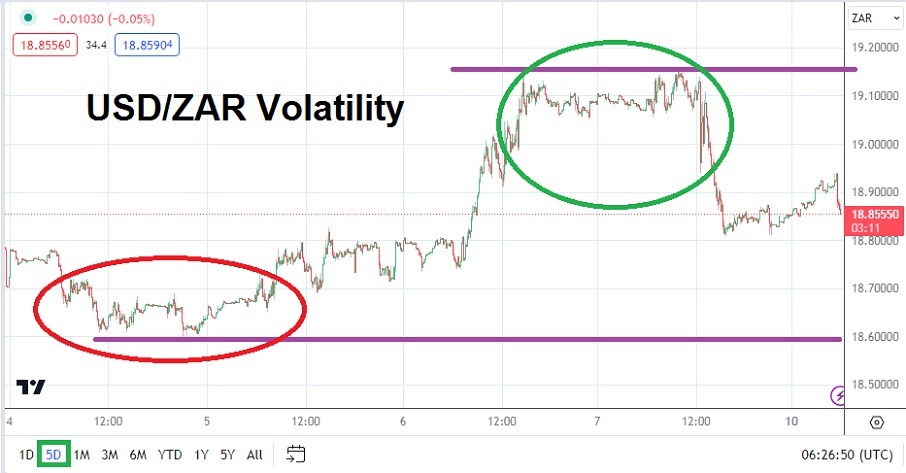

The USD/ZAR is trading near the 18.84800 mark as of this writing. However, the currency pair is moving quickly and readers are urged to check the written price and compare it to the live market to gauge movement. Traders are also warned that the price velocity within the USD/ZAR the past few days of trading have not only made the Forex pair volatile, but also have created a whipsaw type of technical environment. For instance the price of the USD/ZAR at this time last week was near 18.79000 which doesn’t seem far away from the value today, but there is more to the story.

On Thursday of last week the USD/ZAR seemed to be trading within a calm manner around the 18.78000 price with typical give and take Forex action for speculators to wager. Suddenly within a short time period, the USD/ZAR exploded higher and the currency pair was traversing near the 19.15000 ratio, and for almost a twenty hour spurt a range between 19.05000 and 19.15000 was tested. Then upon the publication of U.S jobs numbers on Friday the USD/ZAR sank like a stone and fell to a low around 18.81050 level.

Equilibrium for the Moment Looks Rather Suspicious in the USD/ZAR

The current trading of the USD/ZAR appears rather suspect from a technical and fundamental perspective. While the USD/ZAR has correlated to the major Forex pairs teamed against the USD rather politely in trading the past few weeks, the lower depths now being touched which are fairly close to early last week’s value should be viewed skeptically and will likely see more volatility develop.

Perhaps the notion that global central banks, including South Africa’s, will match interest rate increases from the U.S Federal Reserve is helping creating equilibrium. However, the intraday trading of the USD/ZAR has been violent the past three days, and day traders are cautioned to remain conservative while pursuing the currency pair because dangers lurk.

U.S Inflation Data this Week will Impact the USD/ZAR

- Financial institutions have likely priced in another interest rate hike from the U.S Federal Reserve for later July.

- U.S inflation data released this week will cause more price velocity in the USD/ZAR on Wednesday and Thursday.

Short term traders should look for quick hitting positions which use limited target goals to try and avoid the risk of reversals which could develop. Current support near the 18.82000 level should be monitored, if this level proves durable it could be a sign that the USD/ZAR may provide a place to pursue limited upwards bullish positions for speculators who want to test resistance levels above. Traders should stay realistic and cash out positions if they become profitable.

USD/ZAR Short Term Outlook:

Current Resistance: 18.86600

Current Support: 18.81500

High Target: 18.94100

Low Target: 18.78225

Ready to trade our daily Forex analysis? Here's a list of the best forex trading platforms South Africa to choose from.