Today's recommendation on the lira against the dollar

The risk is 0.50%.

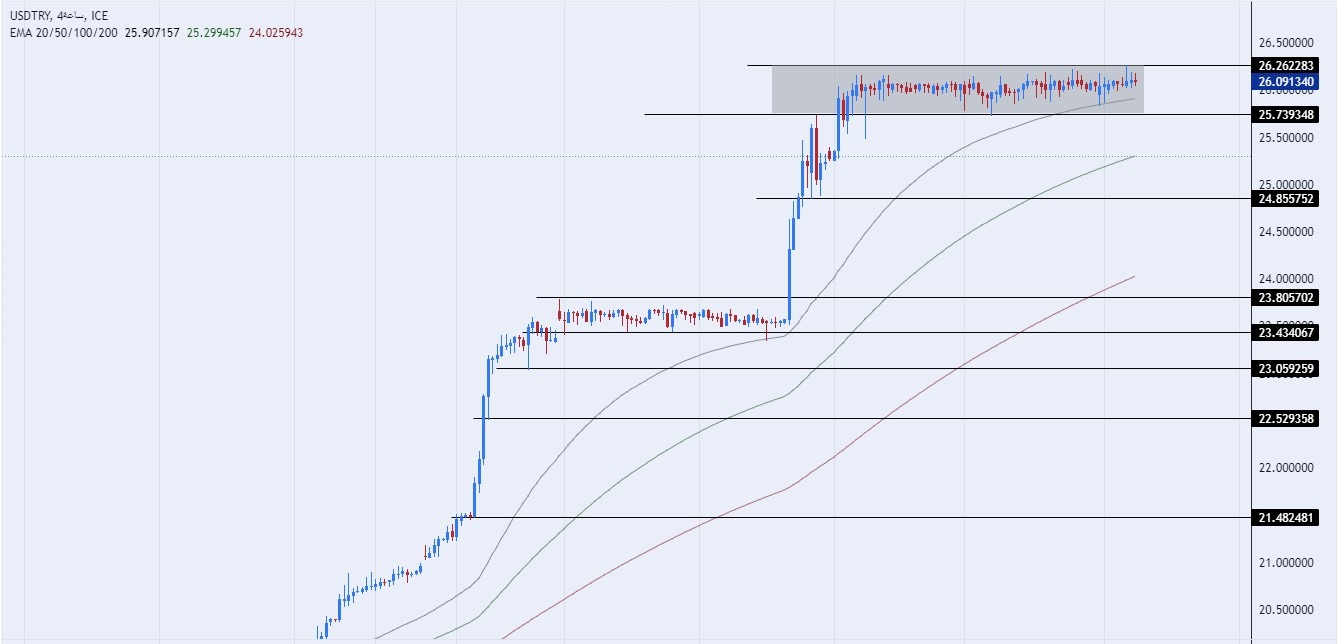

Best buy entry points

- Entering a buy order pending order from 25.50 levels

- Place a stop loss point to close below 25.25 levels.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the remaining contracts until the strong resistance levels at 26.00.

Best selling entry points

- Entering a sell order pending order from 26.00 levels.

- The best points to place a stop loss close the highest levels of 26.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until support levels 25.50.

Tova Bukingolts

Analysis of the Turkish Lira

The Turkish lira stabilized at its lowest level ever against the US dollar during trading at the beginning of this week. The Turkish currency stabilized for the second week in a row.

Investors followed the statements of the Turkish Minister of Treasury and Finance, Mehmet Simsek, who tweeted on the social networking site about his country’s intention to take the necessary measures to prevent the decline in public finance indicators in a sustainable manner.

The government will follow in the next stage to re-establish fiscal discipline by working to reduce the trade deficit, as Simsek stressed In a tweet, the new economic team was keen to increase cooperation in order to achieve greater compatibility between monetary and fiscal policies, in order to reach the current goal of the Turkish government, which aims to control inflation.

Şimşek pointed to the expansion of spending in terms of increasing the welfare of pensioners and state employees by increasing their salaries, as promised by the Turkish president in the run-up to the elections.

Pensions were raised for the lowest salary of a public employee, compared to the end of last year, to reach 141.8%. It is noteworthy that some reports have confirmed the return of intervention by government banks in Turkey to pump more foreign currencies into the markets to meet the increasing demand, which provided some stability to the price of the lira over the past two weeks.

Technical Outlook

- The price of the dollar against the Turkish lira recorded stability during early trading this morning, as the pair traded near its highest levels ever.

- The pair is currently trading within a rectangular range defined within a general bullish trend, which showed a slowdown recently.

- Currently, the pair is trading around 26.10 levels, above the support levels that are concentrated at 26.00 and 25.50, respectively.

The price also settles below the resistance levels that are concentrated at 26.50 and 27.00. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. The effect of the tightening by the Turkish Central Bank on the lira price, which is expected to record some stability at the present time, is expected to be delayed. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.