Today's recommendation on the lira against the dollar

The risk is 0.50%.

Best buy entry points

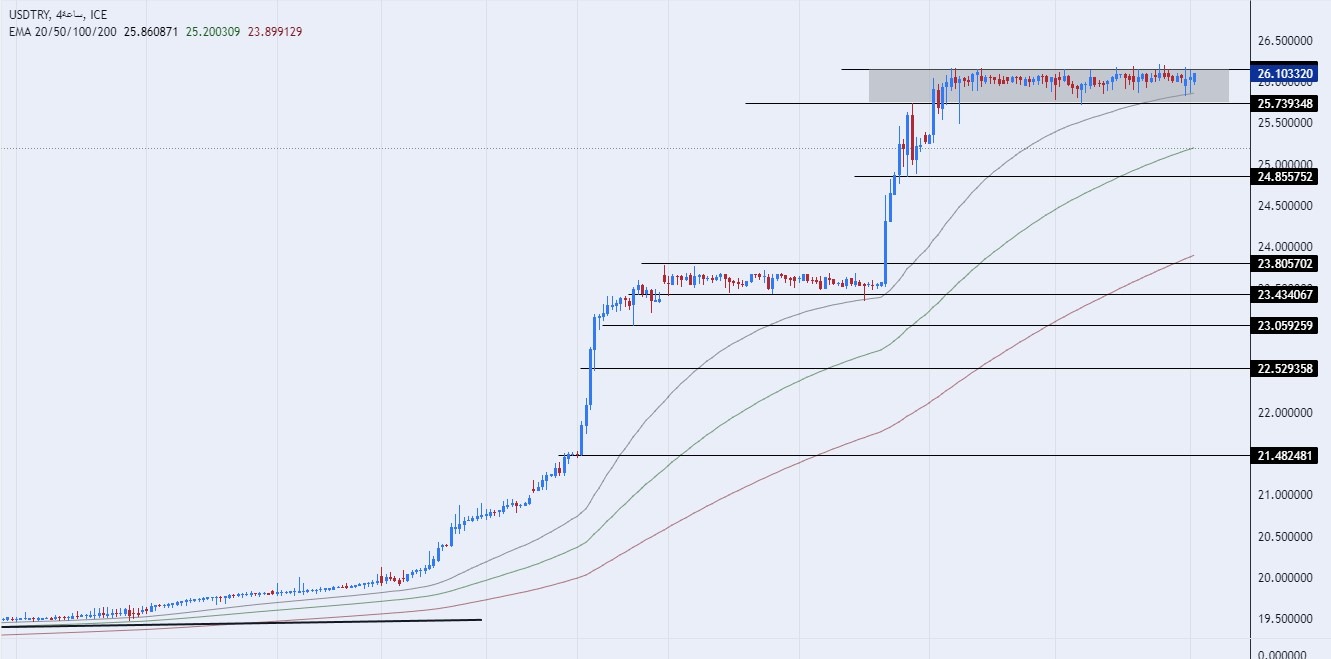

- Entering a buy order pending order from 25.50 levels

- Place a stop loss point to close below 25.25 levels.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the remaining contracts until the strong resistance levels at 26.00.

Best selling entry points

- Entering a sell order pending order from 26.00 levels.

- The best points to place a stop loss close the highest levels of 26.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until support levels 25.50.

Analysis of the Turkish Lira

The Turkish lira stabilized at its lowest level ever against the US dollar during trading at the beginning of this week. The Turkish currency stabilized for the second week in a row, amid reports of signs of the return of government banks’ intervention to control the declines of the lira. The lira lost about 20 percent of its value during the period following the results of the Turkish elections, and the Turkish Central Bank’s decision to raise interest rates by 650 basis points.

This is less than the previous expectations of the markets in increasing pressure on the price of the lira. Reports indicated the intervention of local banks, especially in the period following the Eid Al-Adha holidays, which witnessed an increase in the demand for foreign currencies. It is noteworthy that the official data showed an increase in the net foreign currency reserves of the country’s central bank during the past month, to exceed about $9 billion, compared to negative $5 billion at the beginning of the month, indicating that the sharp decline of the lira was matched by the lack of intervention from the central bank in a strong way. Like the previous periods. Turkish Finance Minister Mehmet Simsek had announced a return to a more rational monetary policy while seeking to increase foreign investments, especially from the Arab Gulf region, during multiple visits from the new economic team or from the Turkish president, who is scheduled to start a tour of the Gulf countries this month.

Technical Outlook

The price of the dollar against the Turkish lira stabilized during early trading this morning, as the pair traded near its highest levels ever. The pair is currently trading within a rectangular range defined within a general bullish trend, which showed a slowdown recently. Currently, the pair is trading around 26.10 levels, above the support levels that are concentrated at 26.00 and 25.50, respectively. The price also settles below the resistance levels that are concentrated at 26.50 and 27.00. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. The effect of the tightening by the Turkish Central Bank on the lira price, which is expected to record some stability at the present time, is expected to be delayed.

Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.