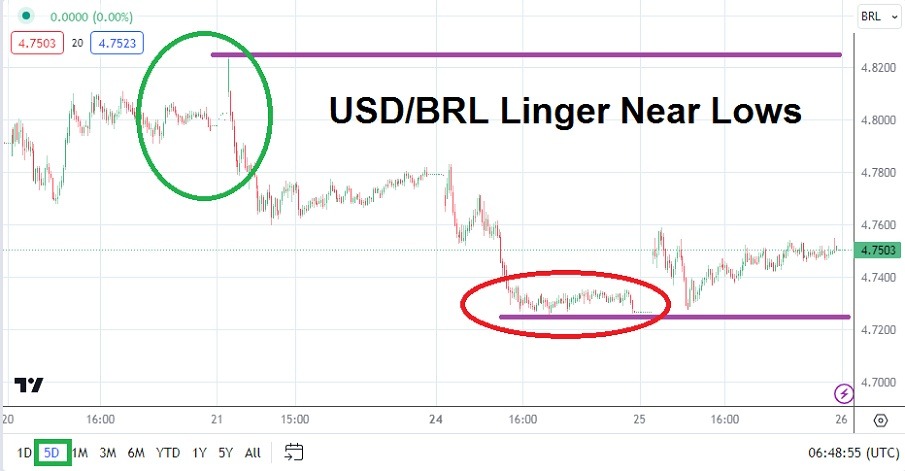

The U.S. Federal Reserve is expected to raise its Federal Funds Rate by 0.25% today; this is as the USD/BRL trades near long-term lows and closed at a value around the 4.7500 ratio yesterday. Bearish pressure has taken the USD/BRL to a level in which it has seemingly lingered the past month, but intriguingly incremental selling has produced new lows recently. On Monday the USD/BRL traded near the 4.7275 ratio, a value it had last seen in May of 2022. Price velocity downwards it needs to be noted, has not been fast.

The anticipated interest rate hike from the U.S. Federal Reserve has likely been priced into the USD/BRL already. If the Fed delivers the increase as expected, the focus of attention for speculators and financial institutions will immediately turn to the FOMC Statement from the U.S. central bank. This is the major unknown that lurks today and could cause volatility in the USD/BRL, so traders will need to have their risk-taking tactics fully in place and operational.

Quiet Market Conditions in the USD/BRL Could Disappear Today

The USD/BRL has been a rather tranquil currency pair the past few months when looking at technical charts. However, the lower incremental trend of the USD/BRL has been evident and speculators may be enjoying the rather sedate nature of the currency pair to deliver rather quiet results. Today’s U.S Federal Reserve pronouncements could change the trading landscape abruptly and speculators need to understand the rather tight price ranges they have enjoyed will likely expand in the coming hours. An interesting sign to watch for will be the opening of the USD/BRL to see if it produces a gap.

The short-Term Price Range of the USD/BRL will widen in the Coming Hours

- If the USD/BRL opens with a gap and moves higher, this may indicate nervous sentiment is building among financial institutions and they are positioning for the potential of a cautious FOMC Statement.

- If on the other hand, the Federal Reserve says inflation has decreased and the U.S central bank wants to examine the next couple of months, to decide which avenue it will take in the mid-term, this could be viewed as dovish and cause more selling in the USD/BRL to ignite.

- Traders should not be overly ambitious because of the Federal Reserve’s coming pronouncements today, staying cautious may serve speculators best and the use of take profit and stop loss orders are recommended.

- Having touched the 4.7275 ratio on Monday, traders may be targeting this level as attractive lower value. However if the price range of the USD/BRL expands today, volatile conditions may cause danger for traders who are not prepared.

Brazilian Real Short-Term Outlook:

Current Resistance: 4.7725

Current Support: 4.7410

High Target: 4.8290

Low Target: 4.6890

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.