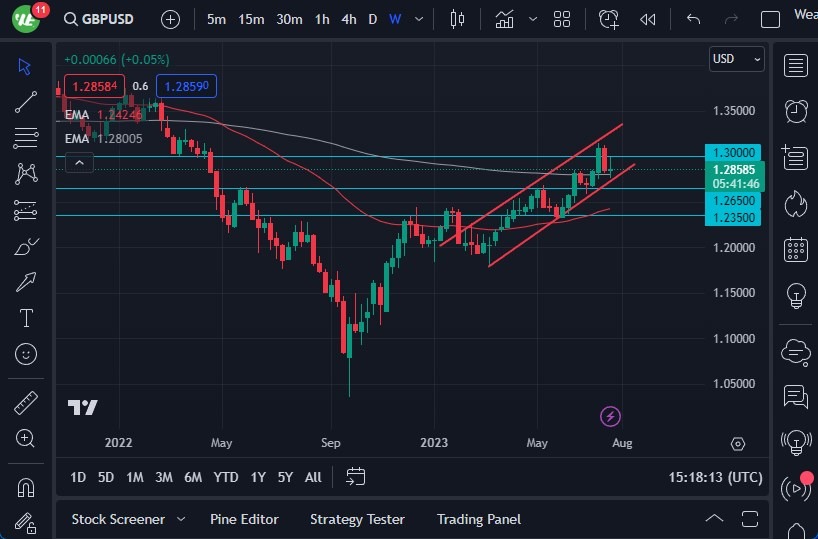

GBP/USD

The GBP/USD has been all over the place during the week, as we are hanging around the 200-Week EMA. The 1.30 level above has been a significant resistant barrier, and therefore I think if we can break above there is likely that the British pound will continue to go higher. On the other hand, if we break down below the 1.2650 level, the British pound will roll off and start dropping. All things being equal, I suspect that this is a market that will probably consolidate over the next week or so.

EUR/USD

The EUR/USD fell a bit during the trading week to break down below the 1.10 level after the European Central Bank shocked the markets by suggesting that the economy in the European Union is slowing down. At the end of the day, we turned around and showed signs of support for the euro and bounced back above the 1.10 level. If we were to break above the top of the weekly candlestick, then it’s possible that your Omega looking to the 1.1250 level, and perhaps even to the 1.15 level after that. Underneath, we have significant support at the 50-Week EMA, closer to the 1.08 level.

GBP/JPY

The GBP/JPY plunged during the training we, only to turn around and show signs of life again. The massive candlestick was formed after the Bank of Japan suggested that they were going to loosen yield curve control, and traders started to run toward the Japanese yen. However, the interest rate differential between the British pound and the Japanese yen will continue to favor the upside. In general, this is a market that I think continues to see plenty of buying on the dip type of behavior. Eventually, I think we will then go looking to the ¥185 level.

USD/CHF

The USD/CHF has shown itself to be somewhat resilient over the last couple of weeks against the Swiss franc, but we are still below the crucial 0.88 level. If we can break above the 0.88 level, then it’s possible that the market could go investigate the 0.90 level after that. Any move above that level then sends the US dollar screaming higher. In general, I think the next week will probably be more back-and-forth consolidation to build up some type of support for a potential recovery. If we break down below the 0.85 level, the bottom is going to fall out.

NASDAQ 100

The NASDAQ 100 has rallied during the week, as it looks like it is trying to do everything you can to get to the 16,000 level. We continue to go through the earnings season, and it certainly looks as if it is going to remain very bullish. At this point, I think short-term pullbacks offer plenty of support, with the 15,250 level being a bit of a short-term floor in the market. In general, this is a market that I think continues to find plenty of buyers based on hunting for value as we continue to see a lot of people taking advantage of the “AI narrative.”

Copper

Copper markets have had a strong rally during the week, but continue to bounce around between the $4.00 level, and the $3.75 level underneath. All things being equal, I think we continue to see a lot of noisy behavior, as we consolidate and try to sort out what’s going on with the overall global economy. Remember, copper, is highly sensitive to global growth and of course demand based on construction and manufacturing. Keep an eye on this market, as it could give you an idea as to where overall risk appetite is going to be going.

WTI Crude Oil (US Oil)

The West Texas Intermediate Crude Oil market rallied a bit during the trading week, breaking toward the $80 level. The $80 level courses a large, round, psychologically significant figure, and if we can break above there then the market could really start to pick up from there, to go investigate the $82.50 level. At this point, short-term pullbacks should be buying opportunities, as it looks like we are trying to go to the $90 level. On the other hand, if we were to break down below the bottom of the candlestick for the week, then it’s likely that the $70 level could be targeted.

Gold

The markets continue to go back and forth during the past couple of weeks, therefore I think we are trying to consolidate and figure out where we’re going next. The $2000 level above is a large, round, psychologically significant figure that a lot of people will be paying attention to. If we can break above there, he could bring in a rush of more buying. Underneath, the $1900 level continues to be a massive support. I anticipate a short-term pullback, followed by more of a “buy on the dip” situation.