Bearish view

- Sell the EUR/USD pair and set a take-profit at 1.0850.

- Add a stop-loss at 1.0950.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 1.0915 and a take-profit at 1.0975.

- Add a stop-loss at 1.0870.

The EUR/USD price has been relatively muted this week because of the US Independence Day holiday and the lack of important economic data. It has remained at ~1.0900 since last Friday as traders wait for the next key catalyst.

FOMC minutes ahead

The EUR/USD will likely see some muted volatility and higher volume as US markets reopen fully. In addition to higher volumes, the pair will react to the latest minutes of last month’s meeting of the Federal Reserve.

These minutes will provide more details of the deliberations that happened in Washington. In the past, the minutes have provided more information about what to expect in the next meetings. Still, most analysts believe that Fed will deliver at least two more hikes later this year.

The minutes will come two days ahead of the latest US non-farm payrolls (NFP) data scheduled for Friday. Economists surveyed by Reuters expect the data to show that the economy added over 200k jobs in June while the unemployment rate held steady at 3.7%.

There will be several important economic numbers that will have an impact on the EUR/USD pair today. S&P Global will publish the latest services PMI numbers from the US and Europe. These numbers will likely show that services output remained above 50 in June, meaning that the sector is doing better than manufacturing.

The other key events to watch will be the latest factory orders data and a statement by Fed’s James Williams. Williams’ statement will also provide hints about the state of the economy and what to expect in this month’s meeting.

Another theme affecting the pair is the slowdown in the European economy. On Tuesday, data showed that the German’s exports dropped by 0.1% in May.

EUR/USD technical analysis

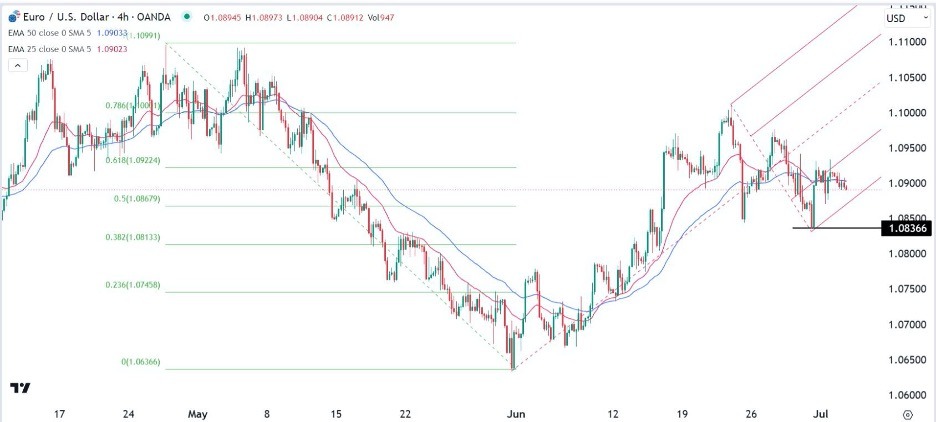

The EUR/USD exchange rate has remained in a tight range this week. It has drifted below the first support of the Andrews Pitchfork tool on the 4H chart. The pair has moved slightly below the 25-period and 50-period moving averages and is above the 50% retracement level.

It has also formed what looks like a head and shoulders pattern. Therefore, the pair will likely have a bearish breakout before or after the Fed minutes. In this scenario, the next support level to watch will be at 1.0850. In the flip side, the resistance for the pair will be at 1.0950.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.