The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are a few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 4th June that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index. The Index ended the week basically unchanged.

- Long of the USD/JPY currency pair following a bounce at a key support level like ¥139.05. There was no such bounce, so this trade did not set up.

- Long of the GBP/USD currency pair following a strong daily close above $1.2500. Thursday’s close was above this level, and it ended the week 0.15% higher from that point.

My forecast produced an overall win of 0.15%, averaging a gain of 0.05% per highlighted asset.

The market is most focused now on the questions of recession, central bank rate hikes, and inflation – and all of these are coming into play in the USA right now, in the world’s major capital market, with the meeting of the Federal Reserve and release of US CPI data due this week. There has been increased speculation that the Federal Reserve will hike rates by a further 25bps at its meeting this week after last week saw identical surprise rate hikes by the Reserve Bank of Australia, followed by the Bank of Canada. However, markets are still implying only a 30% chance that the Fed will hike again.

Another major item is the continuing bull market in stocks, to some extent globally, but particularly in the USA, where the S&P 500 Index reached a 20% gain from its recent low, which is a technical confirmation of a new bull market according to this commonly used metric. The NASDAQ 100 Index reached this level of gain from its low in May. The question is, will the US economy fall into recession and by how much more will the Fed hike, and what impact will this have on the stock market? The Fed is anyway widely expected to hike again in July even if it passes on a hike this month, and the terminal rate is getting to a level where the risk-free return is not far from the average annual return of the stock market. However, this ignored the fact that inflation remains relatively high, which erodes the appeal of such a risk-free rate as it is still lower than inflation.

The NASDAQ 100 Index closed last week at a new 1-year high, while the boarder S&P 500 Index closed at a 10-month high.

Last week’s other key data releases were:

- Australian GDP – this slowed by even more than expected, seeing a month-on-month increase of 0.2% when 0.3% was expected.

- Swiss CPI (inflation) rose by 0.3% month-on-month, exactly as expected.

- US ISM Services PMI came in slightly worse than expected.

- US Unemployment Claims came in a bit higher than expected.

- Canadian Unemployment Rate came in a bit higher than expected, at 5.2% which is meaningfully higher than the rate in the USA.

The Week Ahead: 12th – 16th June

The coming week in the markets is likely to see a considerably higher level of volatility thank last week, as there will be central bank meetings in the USA, the Eurozone, and Japan, plus a release of US CPI (inflation) data. This week’s key data releases are, in order of importance:

- European Central Bank Main Refinancing Rate and Monetary Policy Statement

- Bank of Japan Policy Rate and Monetary Policy Statement

- US PPI

- US Retail Sales

- US Preliminary UoM Consumer Sentiment

- Chinese Industrial Production

- UK GDP

- New Zealand GDP

- US Unemployment Claims

- UK Unemployment Claims (Claimant Count Change)

- Australian Unemployment Rate

Monday will be a public holiday in Australia.

Technical Analysis

US Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a small bearish candlestick last week, in line with its long-term bearish trend.

The greenback remains within a technically valid long-term bearish trend, with its price a little lower than it was both 3 and 6 months ago. However, bears should be cautious of the support level shown by the blue horizontal line within the price chart below at 102.801, which may provide firm support.

I remain nervous to trade against the US Dollar over the coming week because it still looks quite strong, or at least more likely to consolidate than fall. However, we do see some relatively strong currencies, such as the Canadian Dollar and the Swiss Franc, and the British Pound, which are showing some relative strength.

Of course, technical analysis may not be very useful in trading the US Dollar this week, as so much will depend upon the US inflation data and whether the Fed hikes at its meeting this Wednesday.

NASDAQ 100 Index

We saw another rise in the NASDAQ 100 Index over the past week, for the seventh consecutive week. However, the price barely rose, spending most of the week below the weekly open, which suggests the market may be running out of bullish momentum. However, the picture here probably remains bullish, for several reasons:

- The weekly candle closed higher, at its highest closing price seen in over one year, for the fourth consecutive week.

- The weekly candlestick closed not far from its high price.

- Stock markets are generally bullish, and the S&P 500 Index is also technically bullish, but less so, ending last week at a new 9-month high price, and confirming a bull market by all common metrics.

There are no key resistance levels until the 15000 area, so the price has lots of room to rise.

Despite these bullish points, it is worth noting that so much is going to depend, over the short term, on whether the Fed raises rates at its meeting this week, and what the new US CPI (inflation) data says. For example, if the Fed passes on a hike and inflation falls by more than expected, we can expect to see stock markets rise. The bigger surprise will be if the Fed hikes by 25bps and inflation remains stubbornly high, which could trigger quite a strong fall in stocks. Therefore, technical analysis may be of limited use this week.

I think if there is a surprise this week, it will most likely be on the hawkish side.

The NASDAQ 100 Index still looks like a buy to me, but if it quickly retreats below 13730, bulls should be concerned.

USD/JPY

The USD/JPY currency pair fell slightly last week, printing a bearish inside bar which closed a bit lower.

We still see a valid long-term bullish trend, with the close three weeks ago being the highest weekly close seen in the last 6 months. However, the US Dollar overall cannot be said to be in a long-term bullish trend, so there is some conflict here.

We have seen long-term weakness in the Japanese Yen, but there are early indications that the Bank of Japan is beginning to reverse this long-term weakness.

As a trend trader in major currency pairs, I am long of this currency pair and want to remain long unless we see a big drop. However, the case for this long trade is getting weaker, but that could change dramatically if the Fed hikes at its meeting this week, and even more so if US inflation data comes in at an unexpectedly strong level.

This currency pair looks like a buy if it retraces to a key support level and bounces firmly there, notably at ¥139.03.

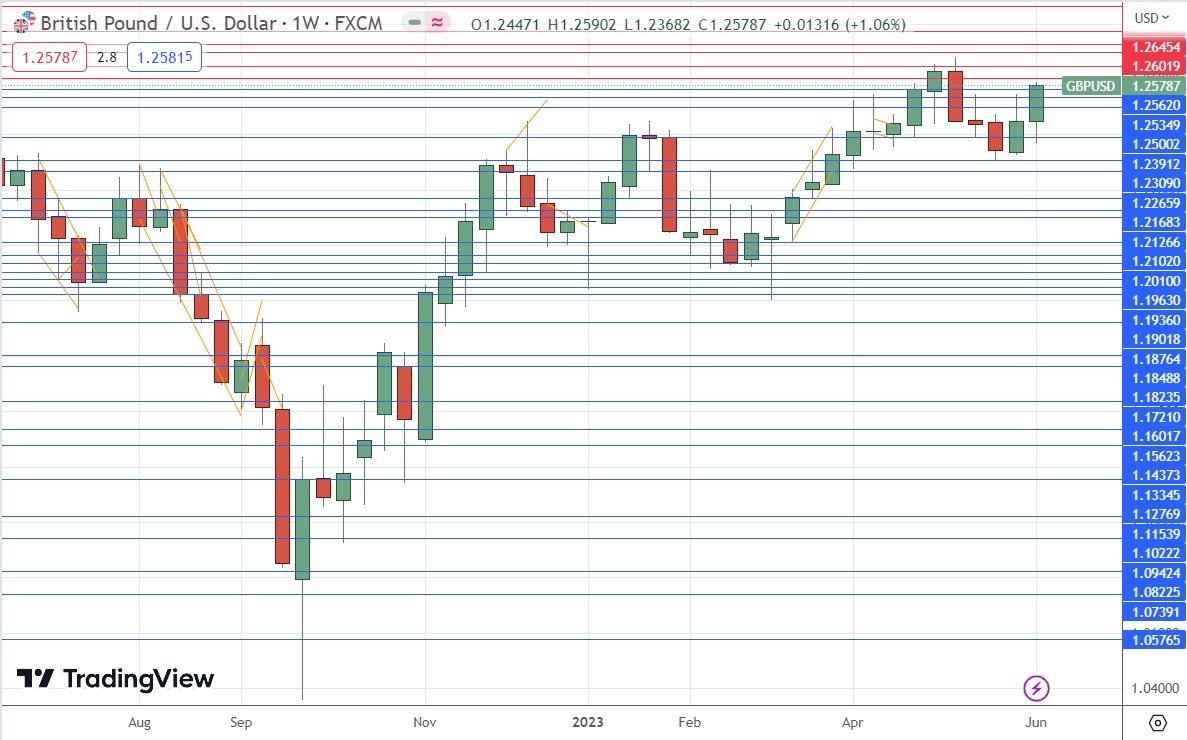

GBP/USD

The GBP/USD currency pair printed a bullish candlestick that closed very near the high of its range, which is a bullish sign. The British Pound is standing out as a relatively strong currency, perhaps even the strongest.

Despite the US Dollar’s questionable direction, the Pound is in a long-term bullish trend, and we now see the price not far from long-term highs above $1.2600.

Technically, we see bullish momentum, which is arguably backed by fundamental analysis as we see hints of a divergent policy between the US Federal Reserve and the Bank of England, with the BoE looking more hawkish while the Fed seems likely to pass on a hike at its meeting this week.

This pair is usually good to trade on breakouts, and as we saw the price move up firmly above the big round number at $1.2500, this currency pair looks like a buy. Of course, if the Fed hikes and US inflation remains strong, that could trigger a sharp fall in the price.

AUD/USD

The AUD/USD currency pair printed a strongly bullish candlestick that closed very near the high of its range, which is a bullish sign. The Australian Dollar is standing out as a relatively strong currency, arguably even the strongest.

The most interesting technical feature is the position of the price and not the weekly candlestick. For some weeks now, we have been seeing the price consolidate below this very strong area of resistance around the big quarter number at $0.6750.

The price may now be at a very pivotal point and may need the confirmation of Wednesday’s Fed meeting to decide whether to make a decisive breakout above this zone of resistance, or a decisive bearish reversal.

This means that there could be a good opportunity to enter a new trade here later this week, it is unclear yet whether long or short.

Cocoa Futures

Cocoa futures powered to a new multi-year high price, closing right on the high of the week’s range. The price chart below shows what a steep and orderly, strong bullish trend this has been, with the price contained neatly by a powerful linear regression channel over the last 40 weeks or so.

There is strong demand for cocoa, as always, but there are supply issues, and there are increasing expectations of a poor crop in the Ivory Coast this year.

This trend is arguably very mature, so buying now could be risky. However, the strength of the bullish momentum here is so strong that it is tempting to become involved, and trend traders will probably not want to miss out on this long trade.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index.

- Long of the USD/JPY currency pair following a bounce at a key support level like ¥139.05.

- Long of the GBP/USD currency pair.

- Long of Cocoa futures.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.