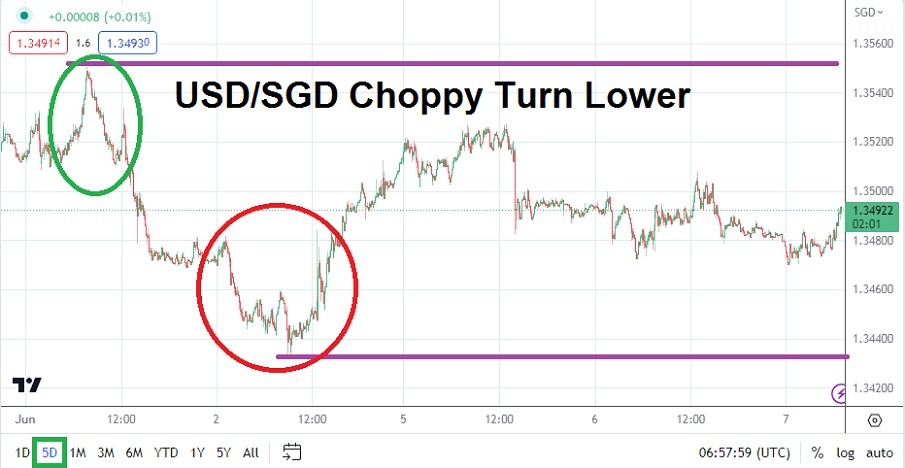

The USD/SGD is trading near a value of 1.34950 as of this writing with the usual rapid price action the currency pair demonstrates. The USD/SGD remains a good barometer of the broad Forex market because of Singapore’s vital place in global economic activity. USD/SGD trading the past month has seen a rather gradual climb higher. On the 10th of May the currency pair was trading near a low of approximately 1.32275, the high for the month of trading was accomplished on the 31st of May when the USD/SGD surpassed the 1.35600 level briefly.

The choppy trading the USD/SGD has demonstrated the past week reflects many major currency pairs teamed against the USD. There is a definite lack of clarity regarding what the U.S. Federal Reserve will do on the 14th of June regarding its Federal Funds Rate. Sentiment in the financial markets appears cautious and rightfully so, as traders await the interest rate decision. Curiously however the SGD/USD has shown some bearish activity recently.

Last Week’s Low on Friday in the USD/SGD Highlights Speculative Nervousness

The USD/SGD traded near the 1.34350 mark last Friday as a low, but this was before the release of the jobs numbers from the U.S. when hiring proved strong. The better-than-expected Non-Farm Employment Change results certainly caused a spark in USD buying throughout Forex, and trading on early Monday saw some additional momentum upwards. However, since then, the USD/SGD has traded slightly lower again as its one-week range essentially stands within a middle ground as of today.

- Traders should expect more choppiness over the next few days of trading.

- There will be no major economic data from the U.S. for the remainder of this week. Yes, weekly unemployment data is coming tomorrow, but it will likely only cause a brief reaction.

- Financial institutions are waiting on the Federal Reserve and its interest rate decision on the 14th of June.

Speculators who Wager on Short-Term Momentum may Prefer USD/SGD Technical Charts

Technical trading in the short and near term is likely to be important as speculators consider their perspectives regarding support and resistance. The ability of the USD/SGD to remain within the middle of its one-week price range and its test of lows recently indicate some financial institutions may remain bearish regarding the USD/SGD. But wagers on the momentum being sustained for longer than one or two hours in the short term will need solid risk management.

Singapore Dollar Short-Term Outlook:

Current Resistance: 1.35020

Current Support: 1.34890

High Target: 1.35325

Low Target: 1.34700

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.