- The US dollar has shown strength against the Japanese yen in Friday's trading session, signaling the greenback's continued resilience in this currency pair.

- This development aligns with the Bank of Japan's lack of decisive action, implying their willingness to maintain loose monetary policies for the foreseeable future.

- Consequently, the Japanese yen is poised to weaken against most currencies, including the US dollar.

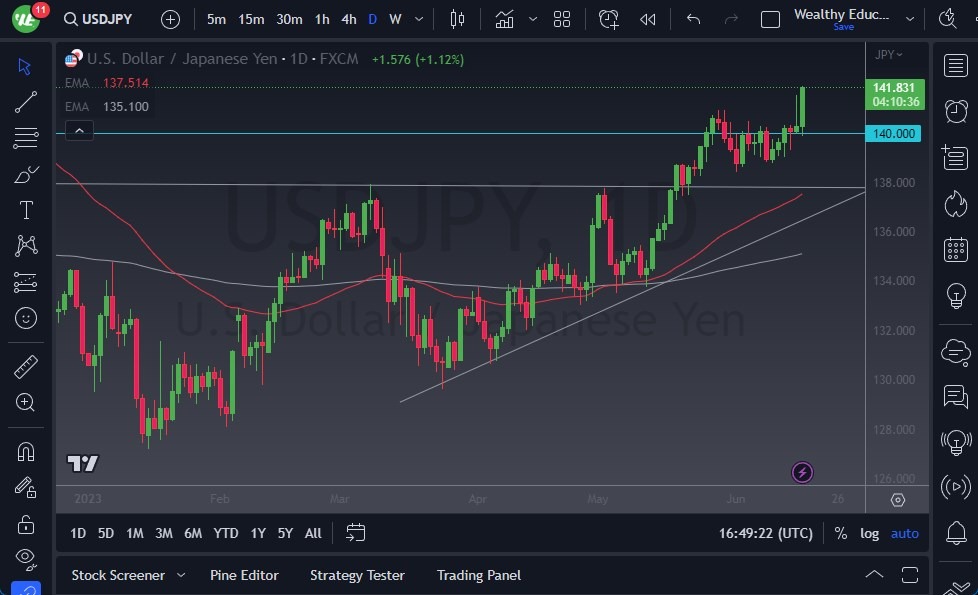

Notably, the market recently broke out of a significant bullish flag pattern, which indicates the potential for an upward move toward the ¥148 level. Subsequently, a target of ¥150 could be within reach. Many traders likely have this scenario in mind, given the current market dynamics. The overall outlook suggests a "buy on the dips" situation, with the bullish flag pattern offering support and indicating the likelihood of an upward surge in due course. Additionally, the ¥138 level, which previously acted as resistance within the ascending triangle pattern, could serve as a potential floor for the market. Traders often take into account historical price levels, leading to the concept of "market memory." Speaking of the ascending triangle pattern, its measurement aligns with a move towards approximately ¥148, further strengthening the bullish case. Considering these factors, it seems only a matter of time before the pursuit of yield continues to propel this currency pair higher, reminiscent of the traditional "carry trade" strategy.

Traders Should Remain Attentive

It is crucial to monitor the market closely, but as of now, there is little indication of a significant threat to the overall bullish trend. A daily close below the ¥138 level would be required to raise concerns. However, at present, such a scenario seems unlikely. Therefore, the long-term perspective favors a bullish stance on this pair.

In the end, the US dollar has demonstrated resilience against the Japanese yen, supporting a positive outlook for the currency pair. The Bank of Japan's inaction contributes to the yen's weakness against various currencies, including the greenback. The recent breakout from a bullish flag pattern suggests a potential upward move toward ¥148, followed by a possible extension towards ¥150. The market's "buy on the dips" sentiment is reinforced by the supportive nature of the bullish flag and the presence of the ¥138 level as a probable floor. Traders should remain attentive to the market's movements, particularly a daily close below ¥138, as it may indicate a shift in the prevailing trend.

Potential signal: The USD continues to race higher, and now it is a buy. A stop loss of 140 is possible, with a target of 145.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to

check out.