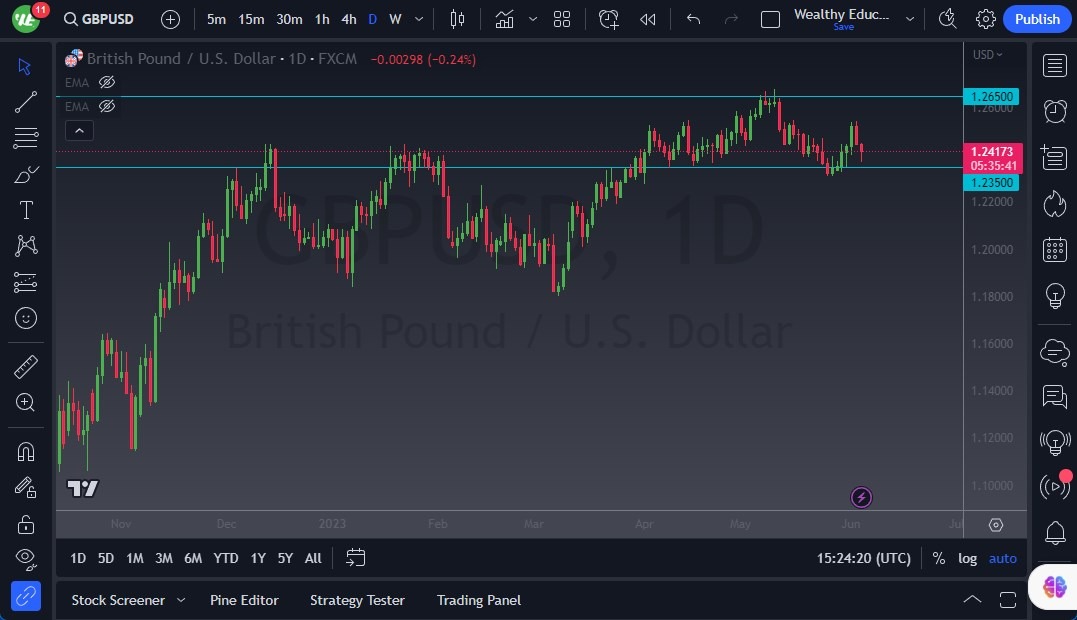

- During Monday's trading session, the GBP/USD experienced a sharp decline, leading to a selloff from the 1.2550 resistance level once again.

- The market continues to struggle, but attention now turns to the 200-Day EMA, which lies beneath as a potential target and a source of support.

- The upcoming price action at this level will be intriguing to observe.

This market has been mired in noise and turbulence within this general range. The 1.2350 level has provided support, while the 1.2550 level has acted as resistance. Consequently, we have witnessed significant volatility in this area, leading to choppiness in the market. A break below the 200-Day EMA could potentially drive the market toward the 1.1850 support level, which has previously garnered considerable interest. It is highly likely that this area will attract substantial attention should the market descend to that point. Furthermore, if we breach that support, it would signal the possibility of further downward movement.

In general, this market is likely to find some support beneath the current levels, resulting in continued volatility. Therefore, caution is advised, and it is essential to avoid overly aggressive positions at this stage. The market is expected to sway along with risk appetite, which is experiencing significant fluctuations. Consequently, traders must exercise vigilance. Additionally, it is worth noting that the US dollar appears to be gaining strength, adding an additional element to consider.

Be Cautious

On the flip side, if the market were to reverse its course and break above the recent high near the 1.2680 level, it could potentially drive the pound toward the 1.30 level. This psychologically significant level will undoubtedly attract significant attention and generate a considerable amount of market noise.

At the end of the day, the British pound continues to grapple with volatility and significant price levels. Monday's sharp decline reflects the ongoing struggle in the market. The focus now shifts to the 200-Day EMA as a potential support level. However, caution should be exercised, given the noise and turbulence within this range. The market's movements will likely align with shifting risk appetite, introducing additional uncertainty. It is crucial to remain cautious while recognizing that the US dollar is exhibiting signs of strength. Conversely, if the market manages to break above the recent high, the 1.30 level will serve as a substantial barrier to overcome, generating considerable market attention.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.