Bullish view

Bearish view

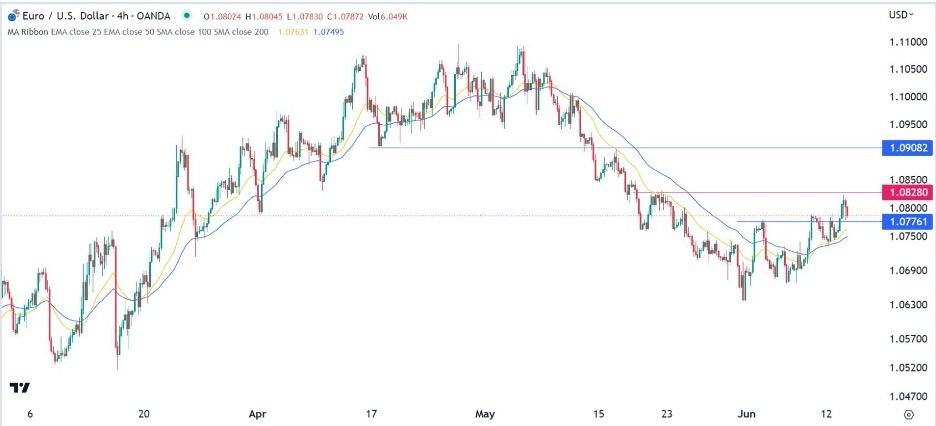

- Set a sell-stop at 1.0760 and a take-profit at 1.0700.

- Add a stop-loss at 1.0850.

The EUR/USD rate jumped to the highest level since May 22 after the latest US inflation data pointed to a divergence between the Federal Reserve and the European Central Bank (ECB). The pair jumped to a high of 1.0824 as the US dollar index dropped to $102.97.

US and European inflation is falling

Economic data published on Tuesday confirmed that consumer inflation in Europe and the United States was falling. In Germany, the headline consumer price index (CPI) dropped to 6.1% in May. Similarly, in Spain, the CPI fell to 3.2%, a few points above the ECB target of 2.0%.

Therefore, these numbers show that the actions of the ECB are working. As such, there is a high possibility that the bank will decide to hike interest rates by another 0.25% when it concludes its meeting on Thursday. Analysts believe that Eurpean interest rates are a bit lower than where they should be.

The EUR/USD price also reacted to America’s inflation data. According to the Bureau of Labor Statistics, the headline CPI dropped from 0.4% in April to 0.1% in May. This decline translated to a year-on-year increase of 4.0%, lower than the median estimate of 4.1%.

The closely-watched core CPI, which excludes the volatile food and energy products, dropped from 5.55 in April to 5.3% in May. These numbers came almost a week after the US published strong job numbers.

Therefore, there is a possibility that the Fed will take a victory lap in its decision later on Wednesday. This means that the bank will leave interest rates unchanged at 5.25%. If this happens, it will be the first time in ten meetings that the bank has not hiked rates.

EUR/USD technical analysis

The euro jumped against the US dollar after the US inflation data. It jumped to a high of 1.0823, the highest point since May 23rd and then erased some of the gains. The pair remains above the 25-day and 50-day moving averages. It also retested the crucial support at 1.0776, the highest level on June 2nd. This is known as a break and retest pattern, a sign of a bullish continuation.

Therefore, the EUR/USD pair will likely continue rising as buyers aim for the next resistance point at 1.0908 (April 17th low). This prediction will become invalid if the price moves below the 50-day EMA.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.