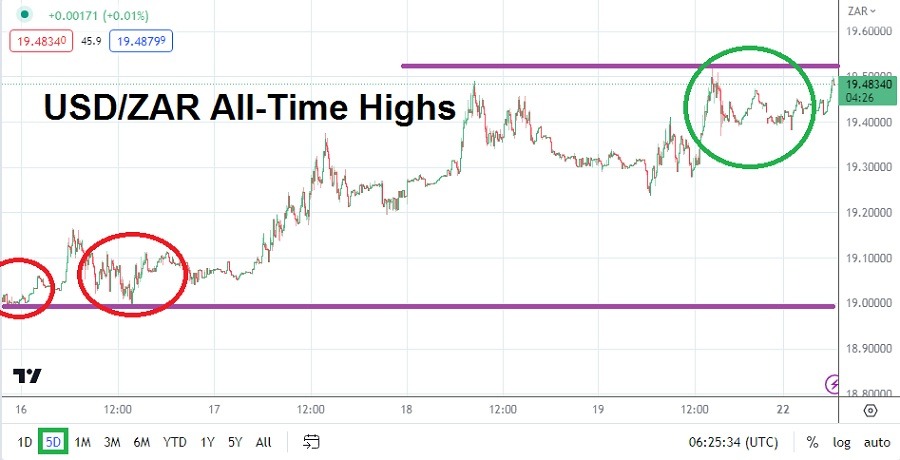

The USD/ZAR is near 19.42800 as of this writing with a flourish of fast trading taking place early this morning. The USD/ZAR is traversing within sight of all-time highs hit last week when the currency pair did trade briefly over 19.52000 on Friday. The record price for the USD/ZAR is no cause for celebration in South Africa, this as the nation continues to grapple with growing concerns about an inability to deliver reliable electrical supply to its citizens and businesses.

South African Banks are Not Optimistic Looking Forward about the USD/ZAR

While other major currency pairs have taken on a weak footing against the USD in recent trading too, the price action of the USD/ZAR is different. The Forex pair appears to be trading on the notion of genuine weakness in the South African Rand. South African banks working with domestic businesses are offering forward contracts to their clients at rates much higher than the current price of the USD/ZAR.

Businesses who want to lock in a value for the USD/ZAR for a contract they will pay in December of this year are being asked to agree to higher rates. Import companies were being asked to agree to a value around the 19.80000 level as of late last week according to local businesses in South Africa. This highlights that financial institutions in South Africa are expecting conditions to get worse and are preparing for a weaker South African Rand looking forward.

Short-Term Traders Should Prepare More Volatility in the USD/ZAR

At the start of last week when the USD/ZAR began it trading near 19.0000, there was a hope the price level could not be sustained. A true test below 19.00000 in the currency pair did not happen and the USD/ZAR simply continued to creep higher.

Yes, reversals lower do take place, but after trading above the 19.20000 ratio last Wednesday the USD/ZAR has shown an ability to maintain its higher values. The 19.20000 level technically, actually feels like distant support in the short term. Traders should be braced for more volatility in the USD/ZAR and use solid risk management.

19.50000 Level may be the Next Important Psychological Mark for Bullish Speculators

- Short-term traders should not get overly ambitious and continue to practice the art of quick-hitting wagers with take-profit orders working – no matter if they are selling or buying the USD/ZAR.

- Resistance near the 19.50000 level in the short term could prove vital. If this level is challenged and proves vulnerable, traders may be tempted to keep looking for upside momentum to be sustained.

- Traders looking for reversals lower should also be cautious, and acknowledge behavioral sentiment in the USD/ZAR is fragile and lower moves may not last long in the near term.

USD/ZAR Short-Term Outlook:

Current Resistance: 19.48900

Current Support: 19.37100

High Target: 19.56000

Low Target: 19.32680

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers with ZAR accounts to choose from.