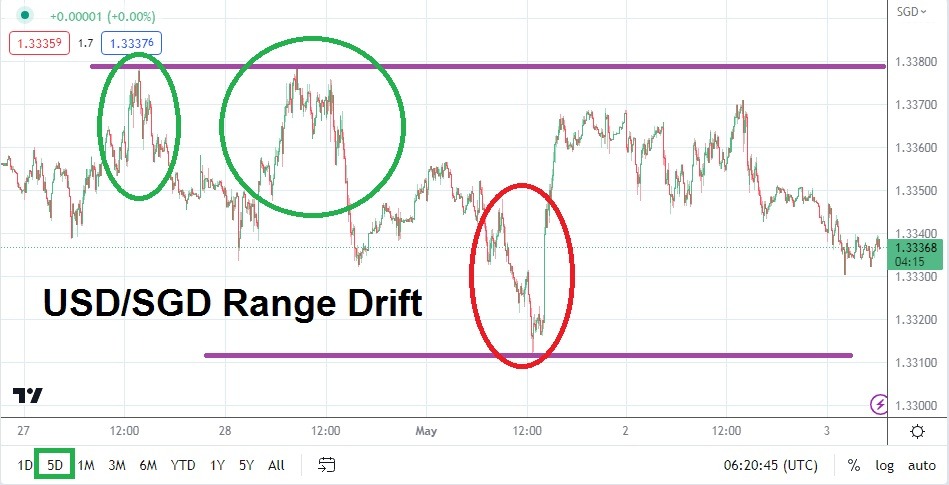

Traders of the USD/SGD have been able to participate in a rather range-bound week, as the currency pair has drifted between 1.33100 to 1.33800 consistently. Speculative pursuit of the USD/SGD and any Forex pair is a matter of perception, what may seem like a tight price range to one person, may be a very wide range to another individual. The amount of leverage used and the choice of take profit and stop loss orders are up to each trader depending on the amount of money they choose to wager on a USD/SGD position.

The U.S. Federal Reserve will release its FOMC Statement later today and this means what has been a rather consolidated price range with a normal set of reversals the past couple of weeks, will likely disappear within a handful of hours. Traders of the USD/SGD need to be braced for a reaction that is likely to create price havoc, the range of the currency pair is certain to widen and it is possible that support and resistance levels not seen in a month or so could suddenly become reality.

The Federal Reserve Will Likely Raise Interest Rates Today, but June is Unclear

As of this writing the USD/SGD is trading near the 1.33350 ratio. A range between 1.33200 and 1.33800 has been rather durable for a while, but day traders pursuing the USD/SGD later today should be ready for these levels to become vulnerable depending on the rhetoric of the U.S Federal Reserve. Financial houses have already accepted the notion that the Federal Funds Rate will be hiked by 0.25% today, but the Federal Reserve’s June outlook remains unclear at this moment. If the Fed suggests another increase can happen on the 14th of June, this may cause widespread volatility in the USD/SGD and other Forex pairs.

- If the U.S. Fed sounds more aggressive than financial institutions anticipate, the USD/SGD could see buying momentum develop.

- If the Fed suggests via its rhetoric that they might consider pausing interest rate hikes in June, this could ignite some speculative selling of the USD/SGD.

Traders Positioned before the U.S Federal Reserve Pronouncements are Gambling

Traders who decide to wager on the USD/SGD before the official FOMC Statement is released later should use extremely solid risk management. Financial markets have shown signs of nervousness in the past day, via major equity indices in the U.S. producing rather strong selling occasionally. While this may be a sign some financial houses think the Fed may sound more aggressive than expected today, there is no sure thing. When clarity is delivered regarding June outlook, volatility will surge immediately after the U.S. central bank’s interest rates insights.

Singapore Dollar Short-Term Outlook:

Current Resistance: 1.33475

Current Support: 1.33235

High Target: 1.34100

Low Target: 1.32910

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.