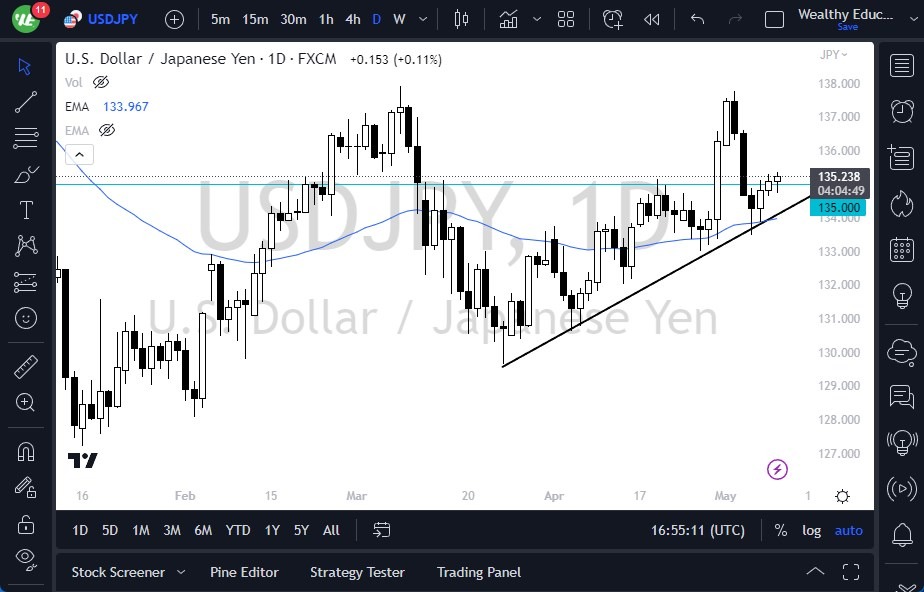

- The USD/JPY has gone back and forth during Tuesday's trading session as it attempts to break above the ¥135 level, which has been noisy in recent times.

- However, when looking at the longer-term charts, it is apparent that the market is in a massive ascending triangle, making it likely that the US dollar will eventually overtake the Japanese yen.

- This is mainly due to the central bank differentials, with the Bank of Japan continuing quantitative easing and the Federal Reserve in an aggressive quantitative tightening phase.

While the Federal Reserve may pause its hikes over the next few months, they are still working off its balance sheet, which tightens monetary policy through alternate channels. Additionally, the Bank of Japan floods the market with the Japanese yen every time interest rates rise to buy bonds and keep yields down. There is also a shortage of US dollars worldwide, as most debts are in the US dollar, and many foreign debtors will continue to demand greenbacks to pay off those debts.

Investors Should Monitor the Market

The 50-Day EMA and 200-Day EMA indicators could offer significant support, making pullbacks considered buying opportunities. The aim is to reach the upside and the top of the triangle, which is the ¥138 level. This could open the possibility of moving to much higher levels, such as the ¥147 level, an area that has been important in the past. While the market's behavior has been choppy, it favors the upside, making it likely that buyers will continue to pick up US dollars.

TL; DR: the US dollar has been going back and forth during Tuesday's trading session as it tries to break above the ¥135 level, which has been noisy in recent times. However, the market is in a massive ascending triangle, making it likely that the US dollar will eventually overtake the Japanese yen due to central bank differentials. The 50-Day EMA and 200-Day EMA indicators could offer significant support, making pullbacks considered buying opportunities. The aim is to reach the upside and the top of the triangle, which is the ¥138 level. While the market's behavior has been choppy, it favors the upside, making it likely that buyers will continue to pick up US dollars. Investors should monitor the market's behavior closely and approach it with caution given its volatility.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.