Advertisement

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 19.60 level.

- Place a close stop loss point below the 19.39 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 20.00.

The best-selling entry points

- Entering a sell deal with a pending order from the 20.00 level.

- The best points for placing a stop loss close at the 20.15 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level at 19.55.

The TRY/USD recorded levels of decline against the US dollar, the dollar recorded levels of 19.75 lira at the time of writing the report. It seems that the decline of the lira will not stop at a certain level even after the second round of the elections is decided later this month. There are increasing fears of economic disturbances that may afflict the country in the post-election period as reports of strong declines in the price of the lira have been counted with the possibility of implementing changes in the country's financial and monetary policy.

The Turk hedges by buying gold and foreign currencies at a time when the Turkish Central Bank is suffering from a decline in the size of the country's cash reserves, which limits the bank's ability to support the lira, which declines daily against the dollar. It seems that the way is open for the lira to record more losses, especially since it is not expected that a fundamental change will occur in the coming days until the end of the replayed round. On the data level, the latest reports issued by the country's statistics office revealed a decline in the unemployment rate in Turkey during the first quarter of this year by 0.3% to record unemployment levels of 9.9%.

USD/TRY Technical Analysis

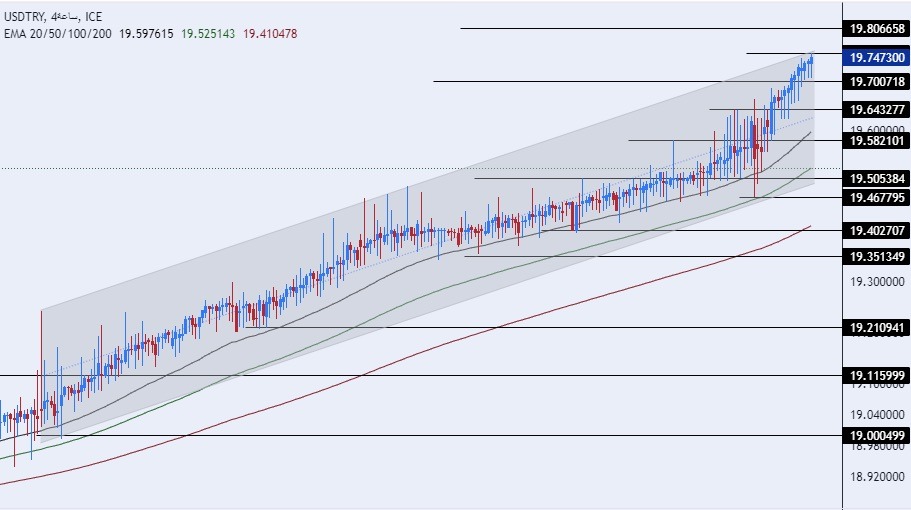

On the technical level, the TRY/USD recorded new highs, after the pair touched levels of 19.75 lira per dollar. where the American currency maintained its continuous gains against the pound which is declining at a slow pace. At the moment, the price is trading within the range of the rising price channel on the four-hour time frame where the price reached the upper limit of the channel, and the price is trading above the support levels which are concentrated at 19.70 and 19.64 respectively.

At the same time, the price stabilizes below the resistance levels which are concentrated at 19.80 and 20.00. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-hour time frame and the 60-minute time frame, indicating a strong general upward trend. Due to the expected changes in monetary policy after the elections, any drop in the dollar against the lira represents an opportunity to buy again. Please adhere to the numbers in the recommendation with the necessity of maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.