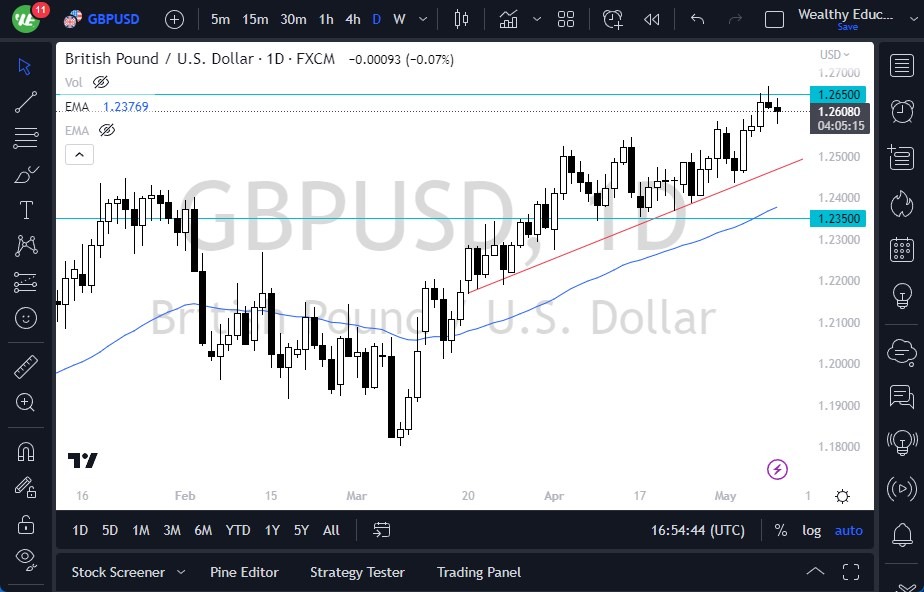

- The GBP/USD experienced initial gains during Tuesday's trading session but ultimately gave back its gains as the US dollar tried to regain some territory.

- The market has been overdone to the upside, so it makes sense that the pair pulls back, perhaps trying to reach the 1.2550 level, an area that previously served as resistance.

- If we break down below the 1.2550 level, the market could drop to the 50-Day EMA, which sits at the 1.2350 level.

While this is a market that will eventually see buyers return to the British pound, it appears that the market has gone too far and too short of a time, making a pullback inevitable. However, if the market were to break down below the 1.2350 level, it could start to fall apart. The market is likely to remain volatile regardless, making it advisable for investors to buy on the dip until the crucial level of 1.2350 is broken.

Be Cautious and Monitor the Market’s Behavior

On the upside, if the market breaks above the highs from Monday's session, it could move to the 1.2750 level. This level has served as resistance in the past, making a break above it possible and opening up the possibility of a move to the 1.30 level. While the Federal Reserve is likely to pause on rate hikes, they will remain tight with monetary policy. This means that although the British pound may benefit from expected behavior from the Bank of England, it may not perform as well as it did in the past against the US dollar.

At the end of the day, the British pound experienced initial gains during Tuesday's trading session before giving back its gains as the US dollar tried to regain some territory. While a pullback is expected due to the market being overdone to the upside, the market is likely to remain volatile, making it advisable for investors to buy on the dip until the crucial level of 1.2350 is broken. On the upside, a break above the highs from Monday's session could open the possibility of a move to the 1.2750 level and beyond. While the Federal Reserve is likely to pause on rate hikes, they will remain tight with monetary policy, meaning that the British pound may not perform as well as it has in the past against the US dollar. Investors should monitor the market's behavior closely and cautiously approach it given its volatility.

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.