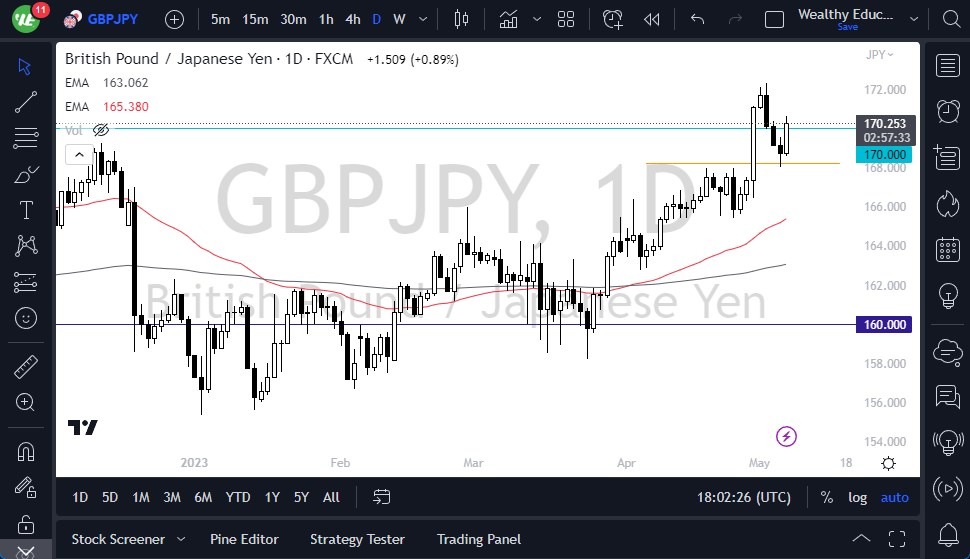

- The British pound has rallied against the Japanese yen during Friday's trading session, as the market continues to see a lot of strength re-emerge.

- The recent pullback in the market has offered value, which has led to plenty of traders jumping back into the market to take advantage of it.

- The ¥172.50 level above is a significant barrier, and it could serve as a nice target given enough time. The fact that a hammer formed during the Thursday session suggests that the trend could continue.

At the ¥167.50 level, there is support just below the candlestick for the Thursday session. A breakdown below this level could open the possibility of a move down to the 50-Day EMA at the ¥165 level. Despite this, the market has shown a lot of resiliencies, and this could be a major factor in the market's future direction.

The Bank of Japan continues to fight higher interest rates by purchasing 10-year JGBs in the open market. To do so, they need to print more currency, which has a significant influence on what happens next. This could lead to the Japanese yen continuing to see a lot of negativities, which could cause the market to look higher. However, this could also result in a very noisy market, making it challenging for investors to make decisions.

Wait for Short-term Pullbacks

In this type of market, short-term pullbacks could present opportunities for investors to take advantage of value. The British pound has continued to see a lot of inflows due to strong inflation in the United Kingdom, which sets the stage for a bullish market.

In conclusion, the British pound has shown a lot of strength against the Japanese yen, and the recent pullback in the market has offered value for investors. While there are significant barriers in the market, the fact that a hammer formed during the Thursday session suggests that the trend could continue. The Bank of Japan's actions to fight higher interest rates could lead to a lot of negativities for the Japanese yen, which could ultimately cause the market to look higher. In this type of market, short-term pullbacks could provide opportunities for investors to take advantage of value. At this point, there is no real reason to think that the yen is suddenly going to pick up momentum.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.