The GBP/USD currency pair has shown initial signs of rallying on Friday, as Sterling continues to display strength. However, the US dollar has picked up some strength due to the release of hotter than anticipated job numbers. It's likely that the British pound will continue to see buyers on dips, but it's also important to recognize that there is a major ceiling just above the current market area. This means that the current market is a "buy on the dip" situation, but it's difficult to get overly excited about getting along just yet, as there is significant noise underneath the market.

GBP/USD Technical Outlook

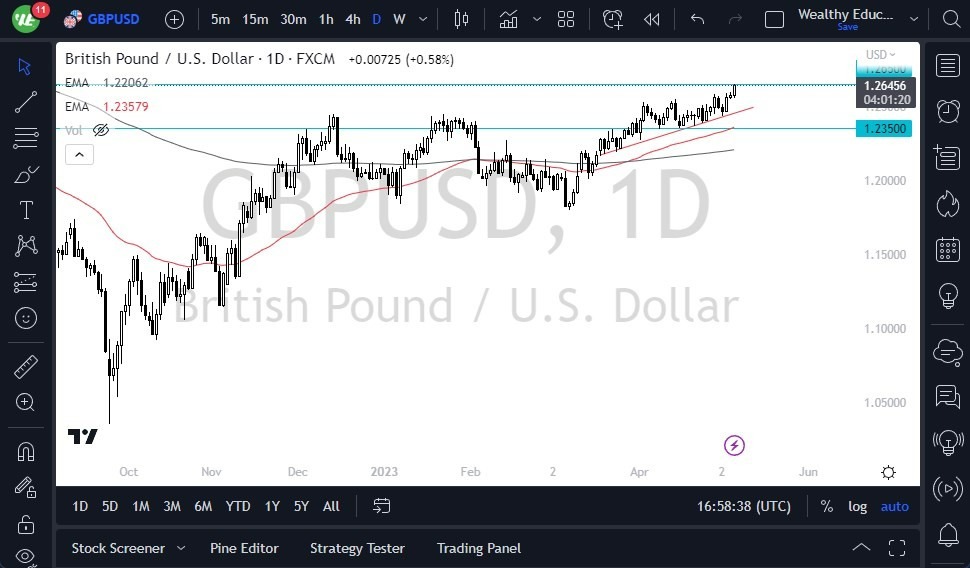

The 50-Day exponential moving average is in the same neighborhood as the current market, and there has been significant consolidation in the past. Therefore, traders need to pay attention to the noise all the way down to at least the 1.2350 level.

- If the market does break above the highs of the Friday session, it would be a very bullish sign, potentially opening up the possibility of a move to the 1.2750 level.

- This is another area where we have seen noise in the past, and after that, traders would need to start thinking about the 1.30 level.

- It is also possible that we will have entered into a “but-and-hold scenario” at that point in time.

It's possible that we could see money run back towards the US dollar due to economic concerns, but the British pound has been one of the better performing currencies around the world. Additionally, the inflation situation in the United Kingdom continues to be sticky. Therefore, it's likely that the British pound will continue to show strength, but at a very stagnant and grinding type of momentum. Traders should not expect big moves in this pair, but a short-term pullback is likely to attract buyers.

Ultimately, the British pound is showing signs of strength despite the US dollar's rally. The current market is a "buy on the dip" situation, but traders should be prepared for significant noise underneath the market. If the market breaks above the highs of the Friday session, it would be a very bullish sign, potentially opening up the possibility of a move to the 1.2750 level. By staying informed and employing a sound trading strategy, traders can potentially profit from the forex market.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.