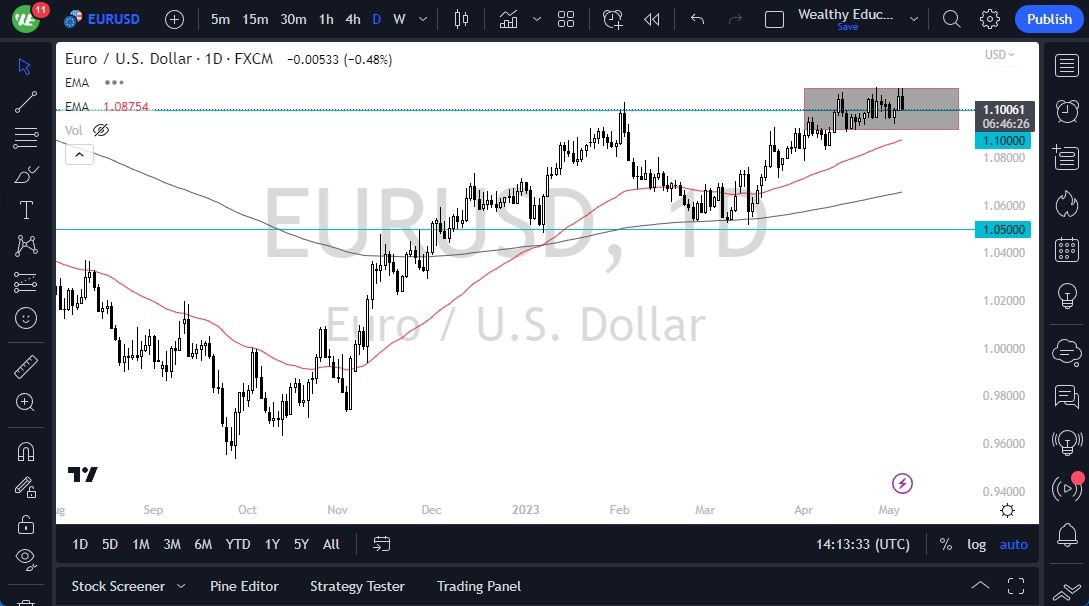

The European Central Bank (ECB) raised its key interest rates as anticipated, causing the euro to initially try to rally during Thursday's trading session before giving back gains. This has left traders wondering where the market is headed next.

At this point, the market is exhibiting a lot of noisy behavior, with the 1.11 level above serving as resistance, and the 1.09 level below acting as support. If the euro were to break below the 1.09 level, it would also clear the 50-Day EMA, indicating the potential for a significant decline. However, if the euro were to pull back from its current levels and find buyers at the 1.09 level, this could be a nice buying opportunity.

Despite the market's indecision, traders are carefully monitoring potential global growth and concerns around the world. The US dollar remains a safe currency, meaning that traders need to exercise caution when determining their position sizing and remain nimble as the market continues to exhibit a lot of noise. Unfortunately, things are probably going to get more confusing, not less. In this environment, things require that you are very vigilant with your position sizing.

You Should Remain Cautious and Vigilant

- While there may be short-term opportunities for traders, it may take a longer-term trade to see a more concrete trend in the market.

- The market is likely to remain sideways for some time, making it difficult for traders to make long-term decisions without seeing some type of huge impulsive candlestick that provides clarity.

It is important to note that the ECB's decision to raise key interest rates has the potential to affect other currency pairs in addition to the EUR/USD pair. Traders need to be aware of this and monitor how other currency pairs may be impacted by this decision. For example, you may want to pay attention to what the euro is doing against so many other currencies, as although its biggest market is against the US dollar, you may find opportunities in other pairs that match the euro against smaller currencies.

Ultimately, the market's current indecision and noisy behavior suggest that traders need to remain cautious and vigilant. They should be prepared to act quickly, if necessary, but should also recognize that the market may continue to be volatile for some time. Only by monitoring the market closely and remaining nimble can traders hope to navigate this uncertain period successfully.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.