- The EUR/USD has had a strong rally in Wednesday's trading session, amidst a lot of noisy behavior in the market.

- However, this upward momentum could be disrupted in the coming days as traders brace for the Federal Reserve and ECB meetings.

- While the Euro is currently experiencing upward pressure, it is unlikely that the market will continue to surge without input from the Federal Reserve.

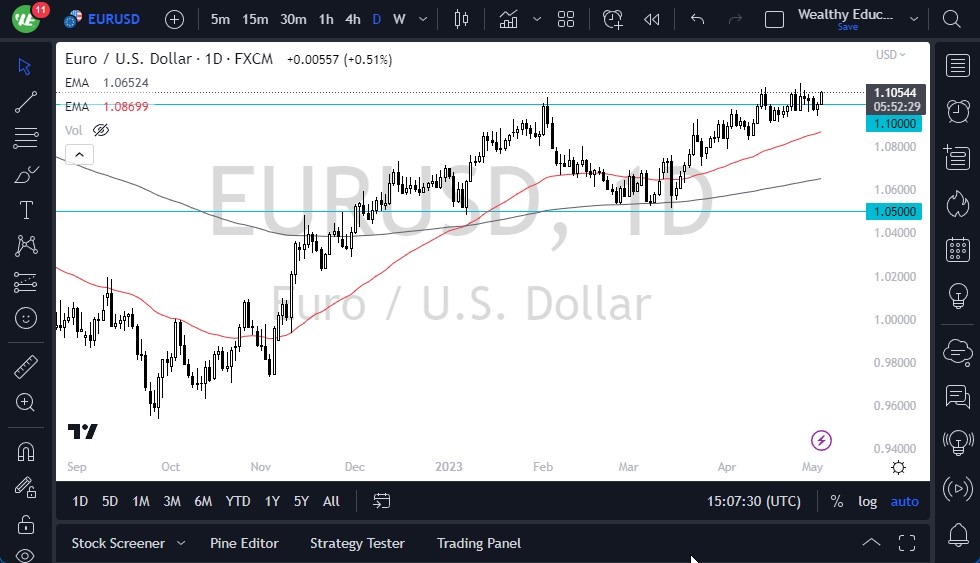

Jerome Powell's statements are expected to influence the market, and if he says something that gives Wall Street hope to start shorting the dollar further, the Euro could continue to rise. However, traders should be cautious about trying to short the market until the daily chart closes below the support level of 1.09.

The 50-Day EMA is currently in the same neighborhood as the support level, which means that traders will be closely following the technical analysis. A daily close below this level could be a very negative turn of events and send the market reeling. This of course would almost certainly be due to economic fear and destruction.

On the other hand, if the Euro breaks above the resistance level of 1.11, it is likely to continue surging toward the 1.1250 level over the next few days. However, given the volatility of the market, traders should be wary of making large bets.

Use Common Sense and Risk Management Tools

Over the next couple of days, both central banks will announce their interest rate decisions and monetary policy statements. This will undoubtedly make the currency pair very noisy and potentially dangerous for traders. Therefore, it is essential to keep position sizes reasonable and use stop-loss orders to limit potential losses. The next few days will certainly be dangerous, to say the least, and you should remember that.

TLDR; the Euro has been rallying in recent days, but the market is likely to continue to be very noisy as traders brace for the upcoming central bank meetings. While the Euro is currently experiencing upward pressure, traders should be cautious about trying to short the market until the daily chart closes below the support level of 1.09. Conversely, a break above the resistance level of 1.11 could lead to further upward momentum. However, given the volatility of the market, it is crucial for traders to use common sense and risk management tools to limit potential losses.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.