- The AUD/USD has been experiencing a lot of volatility in recent trading sessions, with the currency going back and forth as traders grapple with a number of different factors that are affecting its value.

- One of the key issues that is causing concern is the state of global growth, which continues to be a major concern for investors around the world.

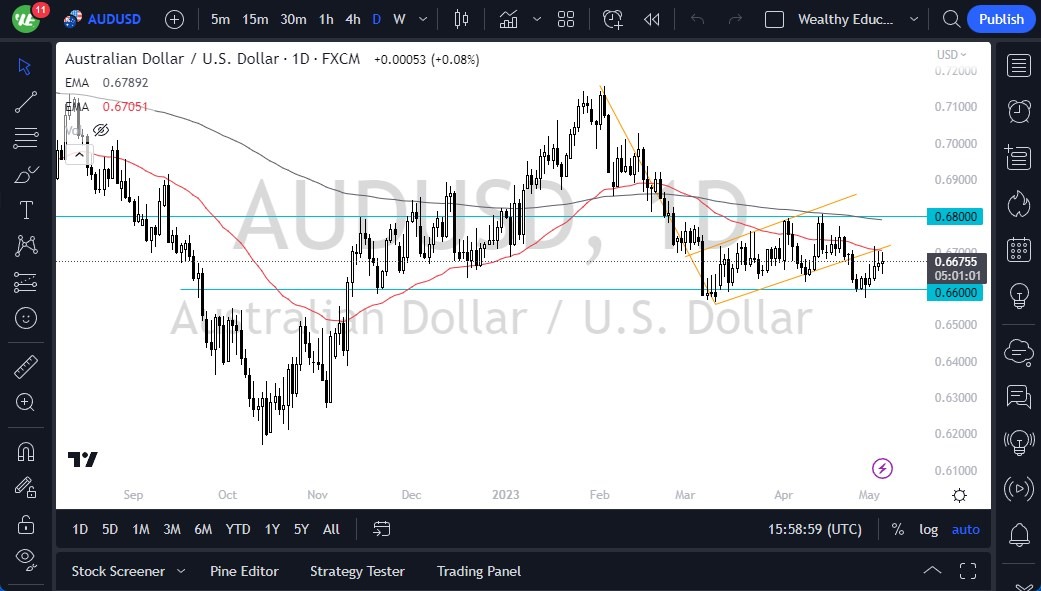

At the moment, there are a number of different technical indicators that are causing resistance for the Australian dollar. For example, there is the 50-Day EMA, which is currently sitting at around 0.6715. In addition, there is the bottom of the bearish flag that was recently broken through, which is also causing significant resistance.

Given all of these factors, it is likely that the market will experience signs of exhaustion in the coming days and weeks. This means that traders will be looking to sell into any rallies that occur, as they will be looking to take advantage of the currency's sensitivity to global economic and commodity demand.

If the currency does break down to a new low, which is currently estimated to be around the 0.6550 level, then there could be a huge breakdown that sees the market fulfill the "measured move" of the bearish flag. This means that the currency could drop all the way down to the 0.62 level quite quickly.

Focus on Your Position Sizing

On the other hand, if the Australian dollar manages to break above the 50-Day EMA, then it could make a move toward the 0.68 level, which is where the 200-Day EMA is currently sitting. This would make it a nice target for traders looking to capitalize on any upside momentum that occurs.

Ultimately, a lot of this will come down to what the US dollar is doing in terms of risk appetite. The Federal Reserve recently raised interest rates by another 25 basis points and reiterated that they are going to stay tight for longer than people expect. This has led to some speculation that the US dollar may continue to strengthen over the longer term.

However, Australians have also had a surprise interest rate hike, which means that there are a lot of different moving pieces that are currently pushing the markets around in both directions. As a result, it is important for traders to focus on position sizing and being nimble, as these will be their two biggest advantages going forward.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.