- The AUD/USD has had a bit of a rollercoaster ride in recent trading sessions, as traders eagerly await the Federal Reserve announcement.

- The market has been characterized by a lot of noisy behavior and confusion, as traders try to decipher the direction of the currency.

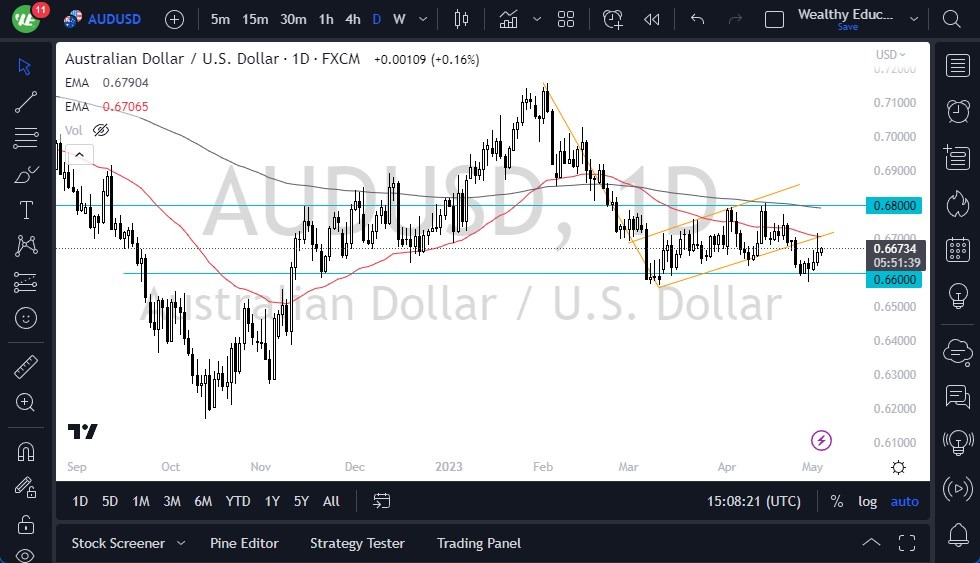

One of the biggest factors influencing the Australian dollar now is the Federal Reserve's monetary policy stance. If the Fed continues to tighten its policy, then we are likely to see a lot of US dollar strength, which could lead to a decline in the value of the Australian dollar. However, if the market were to turn around and take out the 50-day EMA above, then we could see the Australian dollar rise towards the 200-day EMA near the 0.68 level.

The upcoming central bank meeting could be a catalyst for the market to make a bigger decision. The Fed's policy stance will be closely watched by traders, and any indication that the Fed is moving towards a more hawkish stance could lead to a rally in the US dollar, which in turn could cause the Australian dollar to decline.

However, the situation is not clear-cut, and a lot will depend on the perception of what Jerome Powell has to say. The market is likely to be very noisy in the next few days, as traders try to make sense of the competing information.

There is a lot of Uncertainty in the Market

In general, the downside looks more likely for the Australian dollar, given the lackluster returns it has experienced in recent times. The currency had a rather muted reaction to the surprise interest rate hike the other day, which suggests that traders are not particularly confident about the global growth situation.

Furthermore, the Australian dollar is highly levered to risk appetite in general, which means that any negative news could cause the currency to decline. If the market were to turn around and show signs of negativity, we could go looking to the 0.66 level, which would be a very risk-off scenario.

TLDR; the Australian dollar is facing a lot of uncertainty now, as traders try to make sense of the competing information coming out of the market. The upcoming central bank meetings are likely to be very noisy, and the direction of the Australian dollar will depend largely on the perception of what the Fed has to say. However, given the lackluster returns the currency has experienced recently, the downside looks more likely in the short term.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.