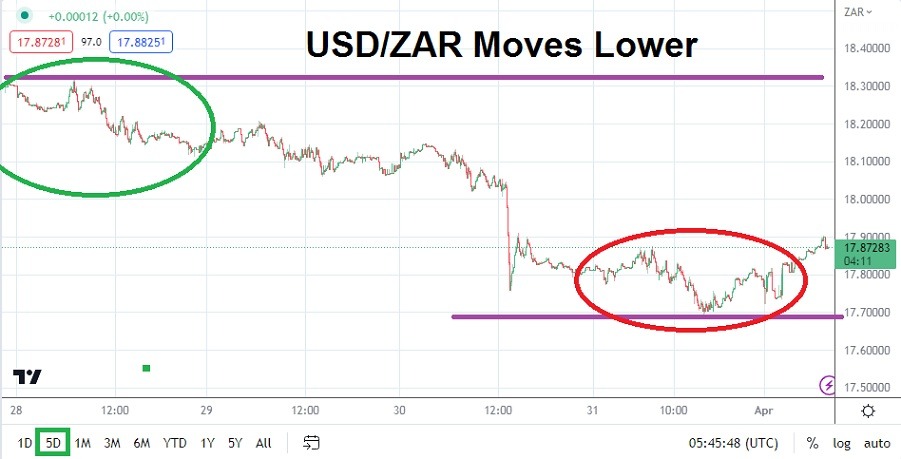

The USD/ZAR started today’s trading near the 17.75775 ratios early this morning, but the currency pair has seen a reversal upwards and is near the 17.93400 vicinities as of this writing. On Monday of last week the USD/ZAR was trading near the 18.33000 ratio and its move lower the past week has been solid. Late last week the South African Reserve Bank surprised many financial houses when it increased its key lending rate by 0.50% instead of 0.25% which was expected.

Aggressive South African Central Bank Move Affected the USD/ZAR

Upon the stronger-than-anticipated interest rate hike from South Africa, the USD/ZAR swiftly moved from about the 18.04400 mark to a low of 17.7500. The USD/ZAR then found some choppy trading, but by Friday the currency pair hit a depth of around 17.69500, before starting to incrementally reverse higher. The push lower certainly was helped by the hawkish South African Reserve Bank last week, and the belief the U.S Federal Reserve may have to become more dovish mid-term.

This morning’s move higher in the USD/ZAR is correlating to the broad Forex market. Financial houses globally may believe the USD has been oversold the past couple of days. While many financial institutions seem to be wagering on the U.S central bank taking a less aggressive interest rate stance mid-term, there is some belief the U.S will see another rate hike of 0.25% in early May. The ability to break below the 18.00000 rate for the USD/ZAR can be viewed as significant. Now will it become resistance that lasts longer than a couple of days?

USD/ZAR Resistance Levels Technically Alluring but very Speculative

- Day traders looking for a retest of USD/ZAR lows should be rather careful and practice strict risk management.

- South Africa remains mired with concerns regarding its economic conditions, and the USD/ZAR moving lower should be examined with speculative considerations which are skeptical.

Choppy conditions should certainly be expected in the USD/ZAR in the near term. If the USD/ZAR is able to maintain a value below the 17.90000 mark in the short term this would be significant perhaps. Traders should be braced for a test of the USD/ZAR’s ‘new’ lower range as fair market value is sought by financial houses which still have many questions regarding South Africa’s economic conditions long-term. Traders who want to speculate on the USD/ZAR may want to use narrow targets that test current technical and support levels over the next couple of days and expect some volatility.

USD/ZAR Short-Term Outlook:

Current Resistance: 17.95000

Current Support: 17.88100

High Target: 18.01200

Low Target: 17.79800

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms South Africa to choose from.