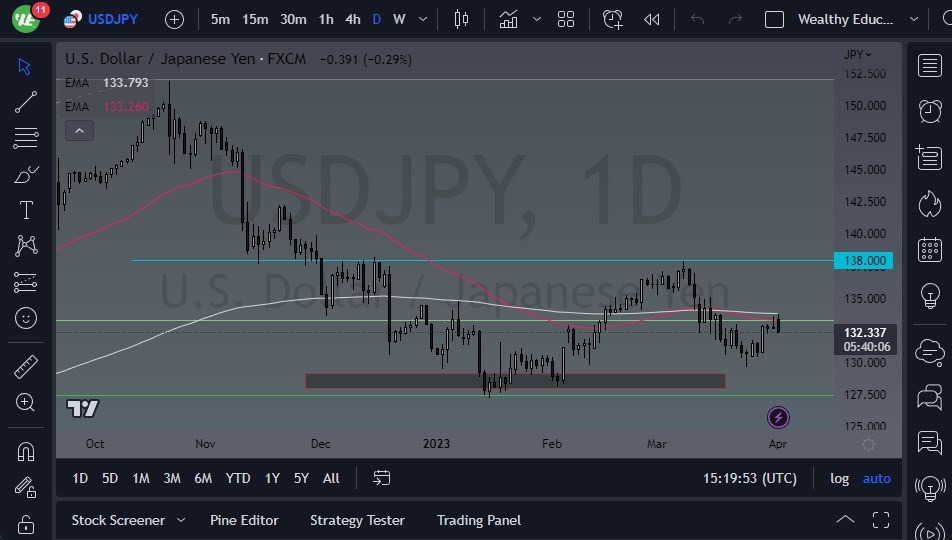

- On Monday's trading session, the USD/JPY initially rallied but struggled at the 200-day EMA, with a shooting star candlestick on Friday suggesting significant resistance in this area.

- Traders should keep in mind that interest rate markets and the Japanese yield curve control situation will affect this pair.

- The Bank of Japan is trying to keep 10-year yields to 50 basis points or lower, leading to massive selling of the Japanese yen, which occurred last year.

A major double bottom has just formed near the 50% Fibonacci level, attracting significant attention, and making it sensible for buyers to be under this level. However, breaking below the ¥127.50 level could lead to a flood of selling and a significant breakdown of support that could send the market much lower. Conversely, breaking above the 200-day EMA could lead the market to look towards the ¥137.50 level, where a significant amount of noise has occurred. Nonetheless, breaking above that level could open a longer-term "buy-and-hold" situation, which would require a significant effort.

Choppiness Ahead

The market is expected to continue showing choppy behavior in this general vicinity, particularly approaching Friday's job numbers in the United States, which will have a significant influence on the market's direction. The Federal Reserve's monetary tightening policy is the main concern for traders now, and any slowdown in the policy could affect the market. There are also the ISM Manufacturing PMI numbers coming out in a contraction level during the day now has people wanting to look for potential safety.

In the end, the US dollar initially rallied on Monday's trading session but struggled at the 200-day EMA, with a shooting star candlestick on Friday suggesting significant resistance. Traders should keep in mind that the Japanese yield curve control situation and interest rate markets will affect this pair. A major double bottom has just formed near the 50% Fibonacci level, making it sensible for buyers to be under this level. Breaking below the ¥127.50 level could lead to significant selling and a breakdown of support. Breaking above the 200-day EMA could lead to a market rally towards the ¥137.50 level. The market is expected to be choppy, with Friday's job numbers and the Federal Reserve's monetary tightening policy having a significant influence on the market's direction.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.