Advertisement

Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD declined during early trading this morning, as the lira settled at an all-time low against the dollar at 19.23 lira per dollar. According to the latest reports published by Bloomberg Agency, many experts suggested that the lira will witness a further decline in the period following the upcoming elections during the month of May.

In the event that the current party continues to rule even with Erdogan changing his economic policy or taking over the opposition, which is expected to tighten monetary policy. The expected impact of monetary policy will not appear immediately on the lira, as it is expected to record further decline against the dollar for several weeks at least. In other news, Turkey's Official Gazette published a decree last Saturday relaxing the rules for saving in lira, as the Turkish Central Bank allowed the country's commercial banks to issue short-term maturities for deposit accounts protected from foreign currency fluctuations in case of demand. The minimum maturity was three months. The central bank, which is indirectly under the authority of the head of state, aims to maintain the stability of the lira ahead of the upcoming elections.

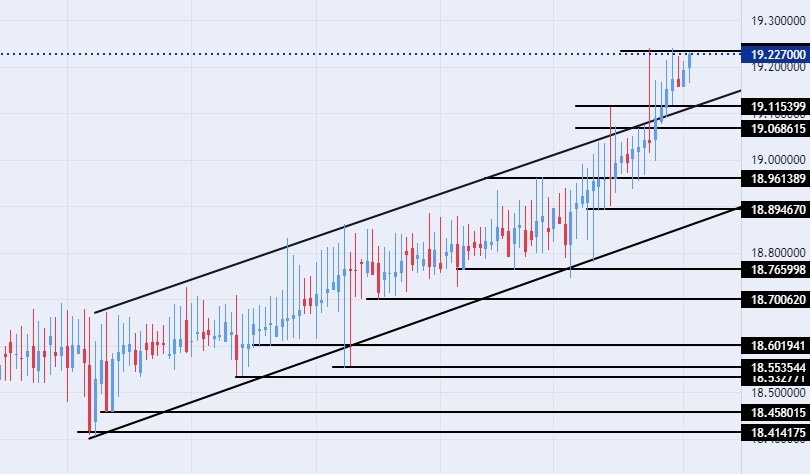

USD/TRY Technical Analysis

On the technical front, the USD/TRY rose slightly during today's early trading, as the pair reached its highest level ever, recording 19.23. The pair retested the upper boundary levels of the bullish channel on today's timeframe, which it had previously breached during last week's trading. The dollar keeps rising against the lira at a slow pace, with the pair trading above the support levels at 19.11, 19.06, and 19.00, respectively.

On the other hand, the price is settling below the resistance level at 19.23, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance level at 19.50. The price is moving above the moving averages 50, 100, and 200 in the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair.

Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.