Advertisement

Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD fell during early trading this morning, after early data issued by the country's statistical center, which revealed that inflation in the country fell more than expected with the stability of fuel and food prices. Inflation in Turkey during the month of March was recorded at 50.51% on an annual basis, compared to 55.2% recorded in February. Expectations were that inflation would reach levels of 51.3% on an annual basis, while inflation rose on a monthly basis by 2.29%. The country suffered from high inflation over the past year, as inflation hit record levels during the month of November after it recorded levels of 85%, which is the highest level in about 20 years, driven by the rise in fuel imports that jumped after the Russian invasion of Ukraine.

Since then, inflation has continued to decline at a slow pace, despite the increase in government spending over the past two months in an attempt to stimulate the economy before the crucial elections expected next month. The Turkish government also increased the amount of spending after the devastating earthquake that struck the country at the beginning of last February.

USD/TRY Technical Analysis

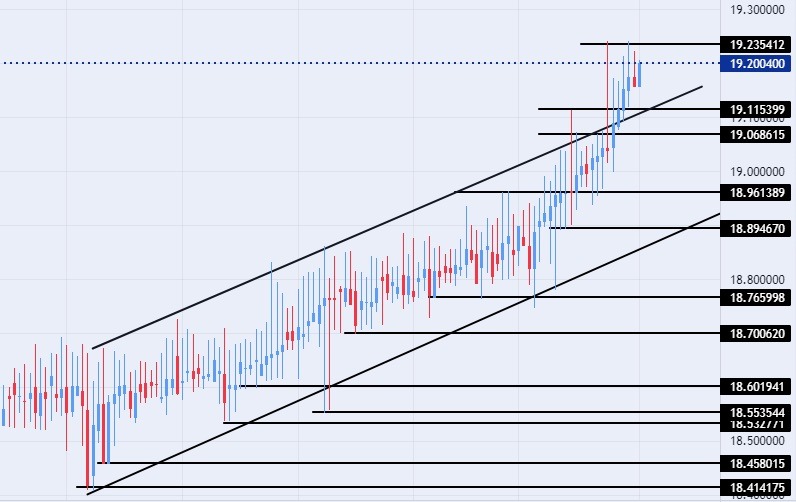

On the technical front, the dollar pair rose against the Turkish lira slightly during today's early trading, as the pair approached its all-time high, recording 19.23, as it traded at 19.19 levels at the time of writing. The pair retested the levels of the upper border of the bullish channel on the time frame of the day Which it had previously breached during last week's trading, the dollar keeps rising against the lira at a slow pace, with the pair trading above the support levels 19.11, 19.06, and 19.00, respectively.

On the other hand, the price is settling below the resistance level at 19.23, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance level at 19.50. The price is moving above the moving averages 50, 100, and 200 in the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair.

Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.