Advertisement

Today's recommendation on the TRY/USD

The risk is 0.50%.

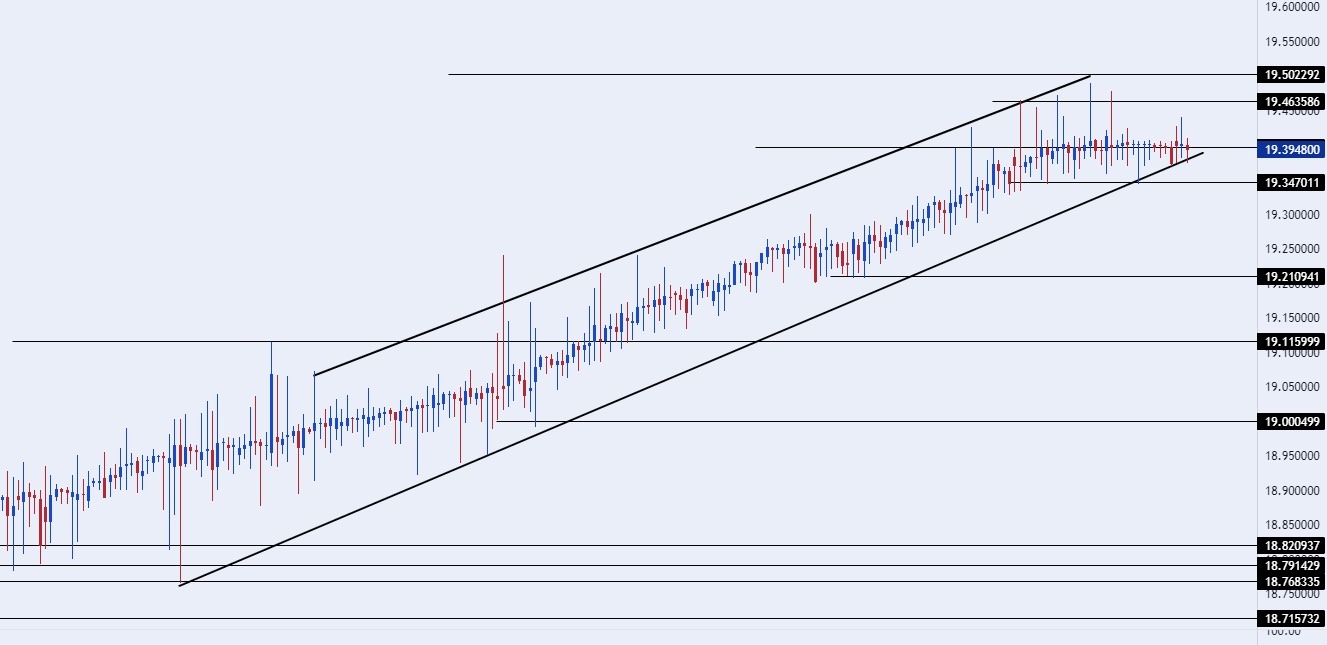

Best buying entry points

- Entering a buy order pending order from the 19.20 level.

- Place a stop loss point to close below the 18.99 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD settled near its lowest level ever against the US dollar, which it recorded during trading at the beginning of the week. And this is in light of the control of the Turkish Central Bank on the exchange rate of the lira, as it controls it by interfering in the markets indirectly by approving some measures that would reduce the demand for the dollar. It is noteworthy that the bank's direct intervention in the markets by pumping more foreign currencies into the markets has declined significantly with the decline in the volume of cash reserves, which were severely affected after the earthquake that struck the country more than two months ago.

Meanwhile, the demand for the dollar increased in the parallel market in Turkey, which witnessed a remarkable recovery after the bank intervened to tighten control over the demand for the dollar, as it was reported that the price of the dollar in the parallel market, which is concentrated in a tourist attraction in the Turkish capital called the Grand Bazaar, has recorded an increase to 20.50 pounds compared to 19.50 in the official market. Experts expect the lira to record more weakness against the dollar in the period following the expected elections in the middle of next month, regardless of the identity of the winning party in the elections, which is driving the demand for foreign currency to rise at the present time.

TRY/USD Technical Analysis

On the technical front, the USD/TRY stabilized without major changes during the day's early trading, as the pair traded near its all-time low, which it recorded during the current week, at 19.46 lira per dollar. Currently, the pair is trading at the lower boundary of the ascending channel on the four-hour time frame, amid the dollar continuing to record gains against the lira, which is taking place with the pair's slow rise, the pair is trading above the support levels 19.30 and 19.20, respectively.

On the other hand, the price is settling below the psychological resistance levels at the integer 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.