Bullish view

Bearish view

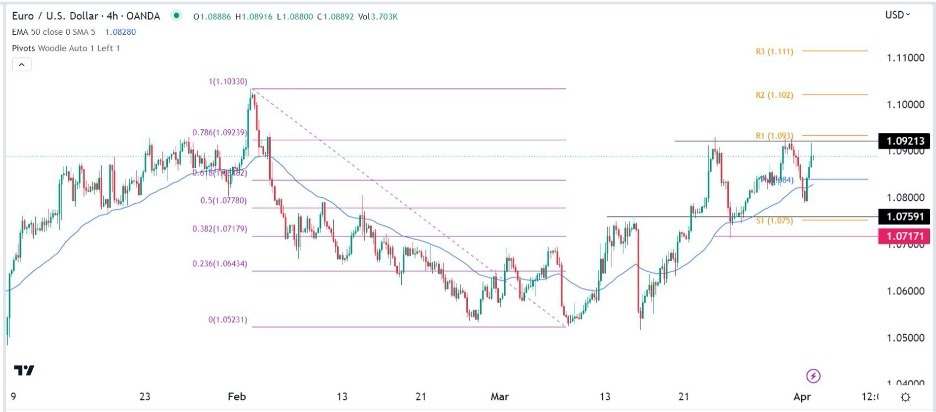

- Set a sell-stop at 1.0860 and a take-profit at 1.0790.

- Add a stop-loss at 1.0950.

The euro did well against the US dollar after the relatively weak manufacturing PMI numbers from the United States. The EUR/USD pair renounced and retested the key resistance point at 1.0921, the highest point in March. It remains ~3.50% above the lowest point in March.

Stagflation concerns

The main catalyst for the EUR/USD pair was the surprise decision by OPEC+ to slash oil production by more than 1 million barrels. The cartel aims to boost oil prices after a lackluster performance in the first quarter of this year.

As a result, West Texas Intermediate (WTI) and Brent prices jumped sharply on Monday. Brent rose to a high of $85 while the West Texas Intermediate (WTI) rose to $80. Some analysts believe that the decision means that the current bear market is about to capitulate.

Higher oil prices could make inflation difficult to beat in the US and Europe. As a result, the Fed and the ECB will need to contend with hiking interest rates during a stagflation period. Still, it is unclear whether these gains will be sustainable.

The EUR/USD pair also reacted to the latest European and US manufacturing PMI numbers. In Germany, the manufacturing PMI dropped to 44.7, which was better than the median estimate of 44.4. In the European Union, the PMI dropped from 48.5 in February to 47.3 in March, better than the estimated 47.1.

The same trend happened in the United States. According to S&P Global, the PMI came in at 49.2, an improvement from the previous month’s 49.1. Another report by the Institute of Supply Management (ISM) showed that the PMI dropped from 51.3 to 49.3. The picture is that the manufacturing sector is recovering at a slower pace than services.

EUR/USD technical analysis

The EUR/USD pair dropped to a low of 1.0760 and then quickly bounced back to a high of 1.0921. This is a sign that buyers are attempting to move above the highest point in March. The pair is hovering near the 78.6% Fibonacci Retracement level. It has also moved above the 50-period moving average and the Ichimoku cloud. The pair also moved above the Woodie pivot point.

Therefore, there is a possibility that it will invalidate the double-top pattern and move to the end resistance of the Woodie pivot point at 1.100.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading brokers worth considering.