The EUR/USD was relatively quiet on Friday, remaining at an extreme level. The market is expected to remain noisy, but with the impending release of the Non-Farm Payroll announcement, many traders will pay close attention. The Federal Reserve has been in the limelight recently due to inflationary concerns, and it is essential to note that strong employment could cause the Federal Reserve to remain tight. The opposite is also true; if employment starts to decline, we could see more of a "risk-on" move.

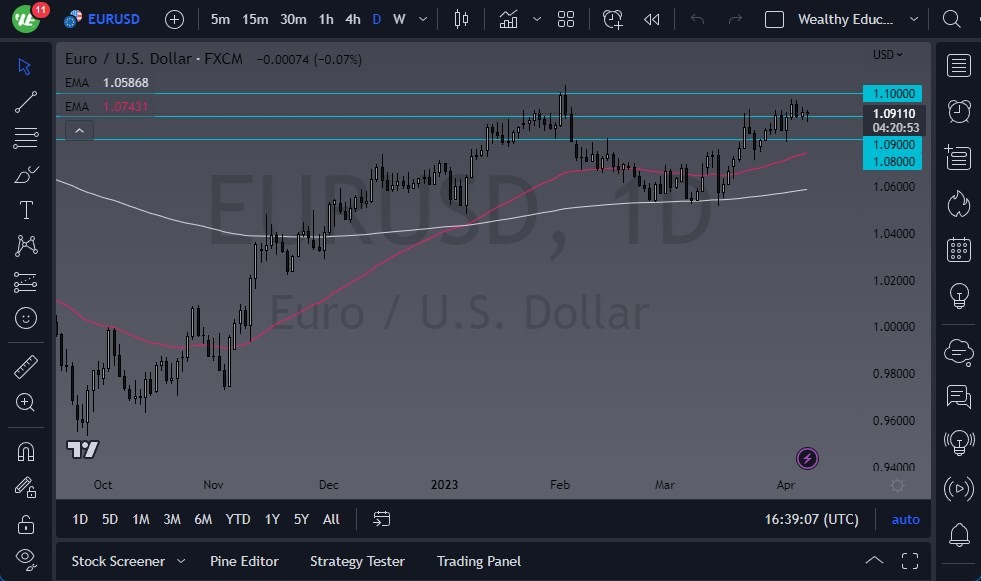

The market is a little overextended, so it is possible that we could see a bit of hesitation. If the market falls below the lows of the last couple of days, it's possible that it could go down to the 1.08 level. The 1.08 level is an area that we have seen a lot of noise at previously, and the 50-Day EMA sits underneath there and is starting to rise.

On the other hand, if the market were to turn around and break above the 1.1050 level, then it's likely that it could continue to rally. It could reach the 1.1250 region, or even as high as the 1.15 level. The market will then look to the United States as it will be a normal day in America.

Good Friday will keep liquidity low, and then we have to deal with massive amounts of bank liquidity being out of the market on Monday as multiple countries in the European Union will be closed. The market continues to see a lot of volatility, so traders should be cautious with their position size. The uncertainty continues to be a significant issue for traders worldwide, not just in this market. However, it is worth nothing that the EUR/USD is a great indicator of US dollar strength, and therefore an important signal.

It's important to keep in mind that the Euro has been on a rally for some time now, but it is starting to face some headwinds. The level at which it finds resistance will be an important determinant of its future direction. Overall, the market is likely to see a lot of noise as we head into the coming weeks, and traders should be careful not to overextend themselves. As always, it's essential to keep a close eye on the market and remain vigilant in managing risk.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.