Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6565.

- Add a stop-loss at 0.6700.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 0.6650 and a stop-loss at 0.6750.

- Add a stop-loss at 0.6550.

The Australian dollar made a bearish breakout to the lowest level in more than a month as after the latest inflation data from Australia and positive American housing numbers. The AUD/USD pair dropped to a low of 0.6620, which was much lower than this month’s high of 0.6803.

Australia inflation data

Australia’s inflation data dropped again in the first quarter in a sign that the actions of the RBA were working. According to the statistics agency, the headline consumer price index dropped from 1.9% in Q4 to 1.6%. On a year-on-year basis, inflation dropped from 7.8% to 7.0%.

The trimmed mean CPI dropped to 6.6% while the weighted mean CPI dropped from 5.8% to 5.7%. These numbers are much higher than the RBA’s target of 2.0%. Therefore, there is a likelihood that the RBA will continue pausing its interest rates in the coming months. It decided to pause its rates in its April meeting.

The main reason for the AUD/USD was the overall strength of the US dollar index. The DXY jumped by more than 50 basis points as a risk-off sentiment spread in the marker. This sentiment happened because of the weak financial results by First Republic Bank, which lost over $104 billion in deposits during the recent bank sell-off.

Its stock, dropped by more than 40% on Tuesday, signaling that the banking crisis is not over yet. The company is now exploring alternatives and is also planning to raise money in the meantime. According to the Financial Times, the company is struggling to find the right strategic alternatives. The worry is that if FRC collapses, it could lead to more regional bank failures.

The key data to watch on Wednesday will be the upcoming US durable goods orders followed by Q1 GDP figures on Thursday.

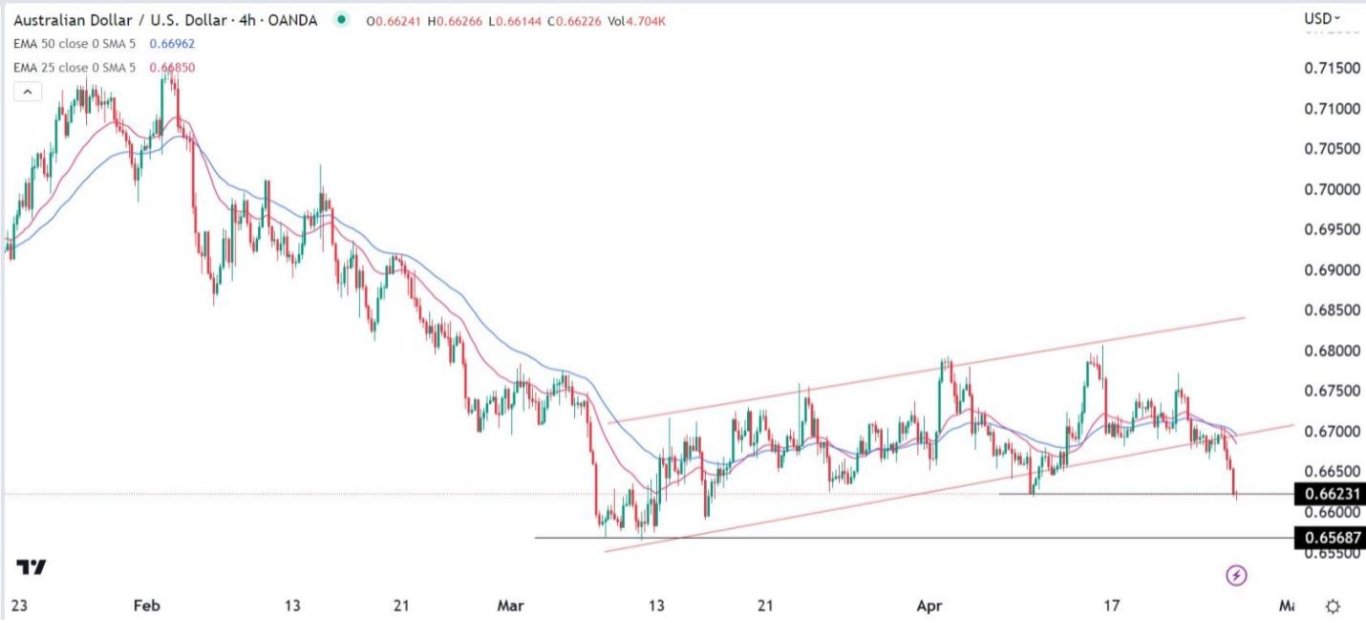

AUD/USD technical analysis

The 4H chart shows that the AUD/USD pair has been in a strong bearish trend in the past few days. This week, the pair managed to move below the lower side of the ascending channel. It has also dropped below the 25-day and 50-day exponential moving averages. Also, the pair fell below the key support level at 0.6623, the lowest point on April 10.

Therefore, the pair will likely continue falling since bears have prevailed. If this happens, the next level to watch will be at 0.6568, the lowest point in March.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex platforms Australia to check out.