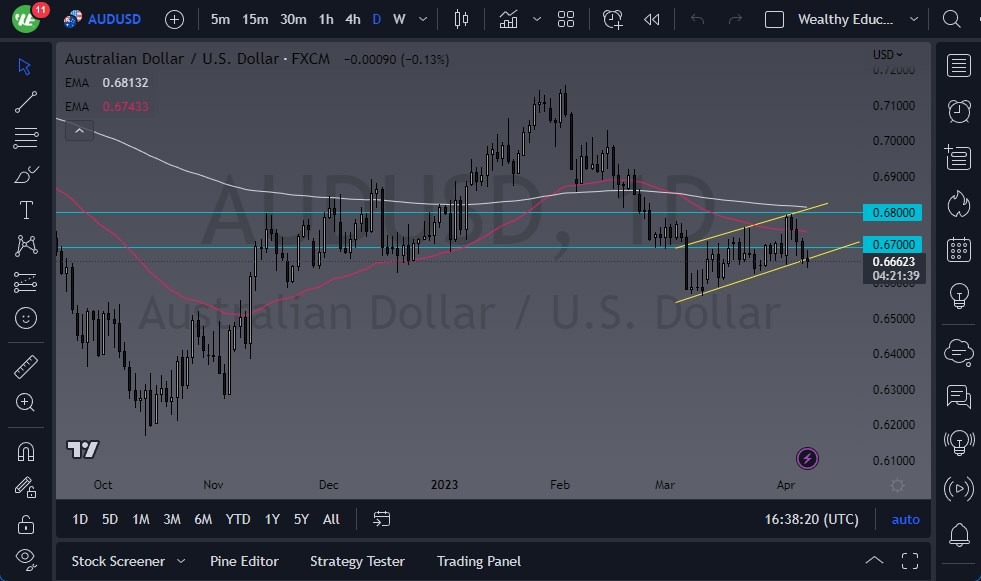

The AUD/USD bounced slightly during the trading session on Friday, reaching the bottom of the channel. However, it's important to keep in mind that it was Good Friday, so only a few Asian countries were open for trading. As a result, we are still in the same position as before the holiday. The 0.6650 level may offer some support, but if we break down below that level, it's likely that the market could fall to the 0.66 level, followed by an even steeper decline. At that point, we may have just broken down through the bottom of a bearish flag.

The 50-Day EMA is currently near the 0.6750 level and is starting to drift lower, while the 0.68 level has the 200-Day EMA, which offers significant resistance. The market has been in a channel, but the question now is whether or not we will break down below it. The market continues to be noisy, so it's crucial to be cautious about the amount of risk you take on.

The Non-Farm Payroll announcement was made on Friday, but as the markets were closed, we won't know the true reaction until we get back to the United States on Monday. Europe will be on holiday, and Asia will likely have limited amounts of trades taken. The announcement will have a significant influence on where we go next, but we are on the precipice of a bigger move, and the levels mentioned previously are areas that we need to pay close attention to. Volatility could continue to be a major issue, so it's important to be cautious about position sizing until the market makes a definitive move in one direction or the other.

The Australian dollar is likely to experience a lot of noise and volatility in the coming weeks. While the 0.6650 level may offer some support, a break below that level could lead to a steeper decline. The market has been in a channel, and whether or not we break down below it remains to be seen. The Non-Farm Payroll announcement will likely have a significant influence, and the market will need to make a definitive move in one direction or the other. It's crucial to be cautious about position sizing and to stay informed about market trends to make informed trading decisions.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.