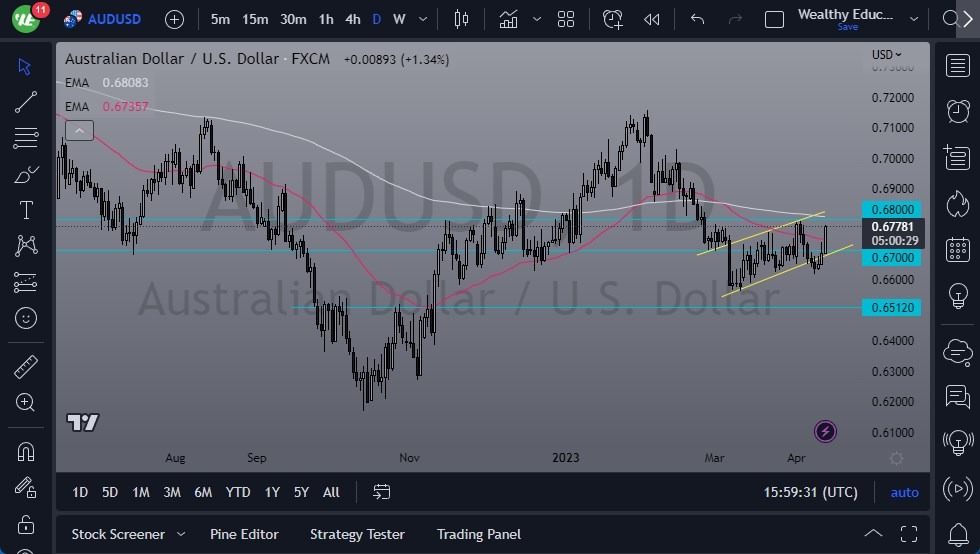

The AUD/USD has shown some signs of strength, but the market continues to be challenged by various resistances, particularly the 0.68 level. Despite that, the currency broke above the 50-day EMA, signaling potential bullishness, but there's a strong possibility that the market will continue to encounter noise as it approaches the 200-day EMA. However, what could influence the Australian dollar is the fact that the global economy is slowing down. The inflation rate in the United States is showing signs of slowing down, which could have a negative effect on the US dollar. Even though Australians have already walked away from interest rate hikes, the market may still be compelled to make a bigger decision sooner or later.

If the Australian dollar breaks above the 0.68 resistance level and the 200-day EMA, it could be a bullish sign, which may lead to the market racing towards the 0.70 level, at least until the market starts to consider the idea of a global slowdown. Traders are betting that the Federal Reserve will bail everyone out, which isn't surprising given their behavior over the past 14 years. In the short term, the market may try to work against the US dollar, but traders should keep in mind that volatility is expected to increase, not decrease. While the Federal Reserve is just starting to see the effects of its past rate hikes, it's expected that traders will eventually look to the short side.

The Australian Dollar is Showing Signs of Strength

- In the long run, it is essential to note that the Australian economy's fate is inextricably linked to China's economy, given that China is Australia's primary trading partner.

- Any developments in China's economy, such as growth or decline, will affect Australia's currency. The Reserve Bank of Australia (RBA) has not signaled any plans to raise interest rates, and they are not expected to do so in the near future.

- The RBA is likely to keep the official interest rate on hold until at least 2023, which could have a negative impact on the Australian dollar.

The Australian dollar could also be influenced by the country's monetary and fiscal policies. The country's economy is showing signs of recovery, and the government has been implementing various stimulus packages to boost it. Additionally, the Australian government is taking measures to increase investments in infrastructure and other sectors, which could have a positive impact on the economy in the long run.

Ultimately, while the Australian dollar is showing signs of strength, the market will continue to encounter resistance, and traders should be cautious with their position sizes. The global economic slowdown, the Federal Reserve's behavior, and the RBA's monetary policies are some of the factors that could influence the Australian dollar in the long run. Nonetheless, the Australian government's fiscal policies and investment in infrastructure could have a positive impact on the economy in the long term.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.