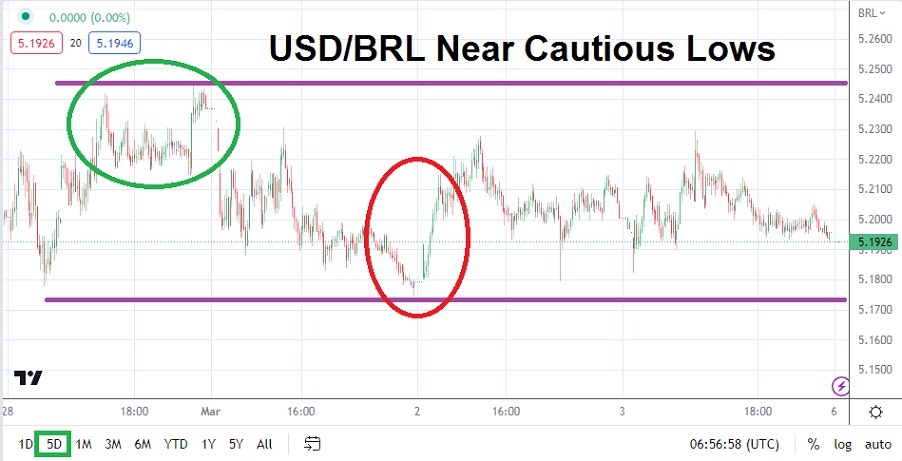

The USD/BRL went into the weekend near the 5.1925 ratio as it displayed the ability to remain within sight of its near-term lows. Trading action today should be watched when the USD/BRL opens to try and get a read on existing sentiment within the currency pair. The price range of the USD/BRL has been rather consolidated over the past two weeks. The high for last week in the Forex pair was near the 5.2475 ratios on the 28th of February, the lows occurred on Monday and Wednesday when the USD/BRL traded near the 5.1720 levels.

Financial Houses appear Calm for the Moment, but it may Not Last

Traders of the USD/BRL may feel comfortable for the time being considering the price range of the currency pairs over the past couple of weeks. However, there are major risk events on the economic calendar in the coming days, tomorrow Federal Reserve Chairman Jerome Powell will be asked questions regarding U.S. central bank monetary policy. Speculators of the USD/BRL and other Forex pairs have certainly digested the acknowledgment of another rate hike from the U.S. Federal Reserve on the 22nd of March; however, the question is how many more times the Fed will raise rates going into the spring and summer.

- U.S. Non-Farm Employment Change data will be published on Friday. Hiring statistics will be watched closely, a stronger-than-expected number could mean more USD strength.

- The Average Hourly Earnings will also be released on Friday; this number will provide insights into inflation. A weaker-than-expected result could favor the selling of the USD/BRL.

Calms Seas could turn into a Sudden Storm for the USD/BRL

Experienced traders of the USD/BRL know the USD/BRL could provide a gap upon its opening after the weekend. If the USD/BRL opens with calm trading conditions and continues to pursue the price range it demonstrated last week this will provide traders with an opportunity to wager on technical support and resistance levels.

Tranquil trading conditions may be exhibited today, but in anticipation of Fed Chairman Powell’s remarks tomorrow, the USD/BRL may begin to see some speculative positioning slightly before his testimony to the Senate. USD/BRL traders who have become accustomed to a lack of volatility the past couple of weeks should still practice solid risk management because if and when consolidation fades away the USD/BRL could suddenly move rapidly. Narrow price targets pursuing the potential of short bursts of momentum in the USD/BRL look favorable in the short term as wagers for day traders.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2050

Current Support: 5.1860

High Target: 5.2375

Low Target: 5.1670

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.