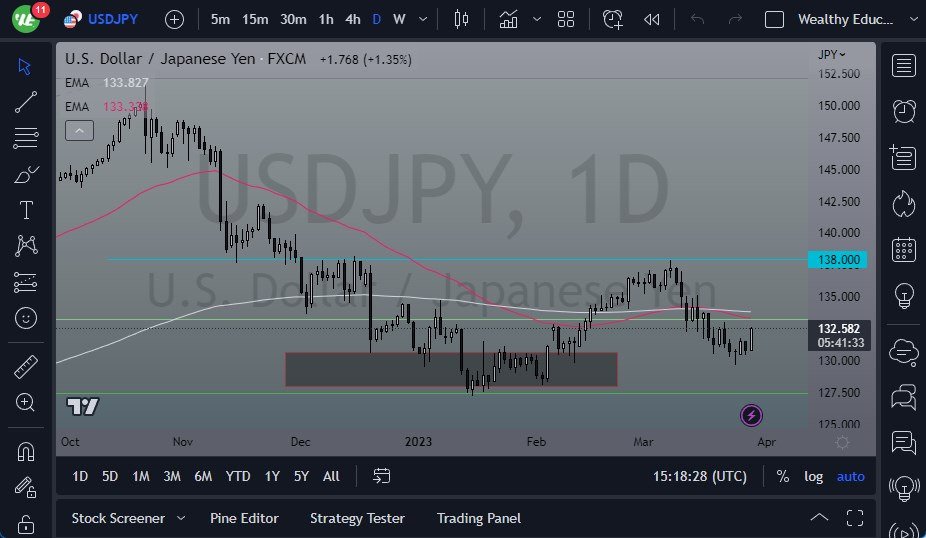

The US dollar has rallied significantly against the Japanese yen during Wednesday's trading session, reaching the crucial ¥132.50 barrier. This area has been important support and resistance over the last few weeks, suggesting it will continue to be somewhat important in the future. The size of the candlestick is impressive, which traders should keep in the back of their minds. The 50-Day EMA is also dropping significantly, sitting closer to the ¥133 level, which may lead to resistance. However, if bond markets provide enough reason, traders may eventually break through that significant support and resistance level.

Possible Bottoming Pattern

The Bank of Japan is doing everything it can to keep interest rates down, defending the 50 basis points barrier on the 10-year JGB. If interest rates rise worldwide, it puts pressure on the Bank of Japan to print yen to buy those bonds, a game that has been played for the past year and continues to be the biggest driver of the market. The technical analysis also supports the current market dynamic, as we have recently tested the ¥127.50 level, which is the 50% Fibonacci level from the significant move last year. We have formed a double bottom, which has led to a rally, and although we have pulled back since then, we are turning right back around. This suggests we are in the process of building a bottoming pattern, but it's still too early to confirm.

In Summary

The US dollar has rallied significantly against the Japanese yen, reaching a crucial resistance level. The Bank of Japan's efforts to keep interest rates down and the global interest rate situation remain the primary drivers of the market. Traders should keep an eye on the technical analysis and the bond market to gauge potential bullish moves in the market. After all, we have recently seen a significant pullback, and that does tend to put a few issues for buyers in the market.

- It certainly looks as if we are trying to recover, so ultimately this looks more or less like a “buy on the dip” market.

- If the market can break above the 200-Day EMA, then it’s possible we could reach the ¥138 level.

- That’s an area where we have seen action in the past, and therefore a bit of “market memory” could come into the picture there.

Ready to trade our daily Forex analysis? We’ve made a list of the best currency trading platforms to trade Forex worth using.