Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

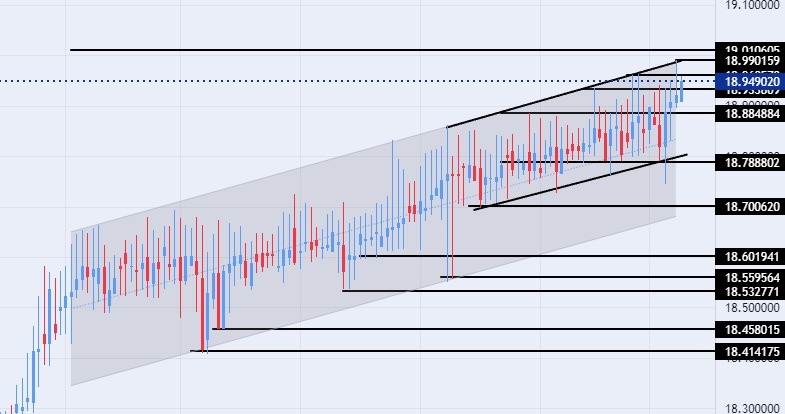

- Entering a buy order pending order from the 18.80 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD declined during yesterday's trading, Wednesday, as it broke its lowest level ever, to continue the general trend in the red color recorded by the Turkish currency. The lira was affected by expectations of tightening monetary policy in the United States of America, which gave a boost to the US dollar at the expense of emerging market currencies. In his congressional appearance, Federal Reserve Chairman Jerome Powell shouted a strong signal of an acceleration in interest rate hikes.

In the hours after his remarks, the probability of a rate hike in March rose by 50 basis points to 70%. On the other hand, the Turkish Central Bank controls the price of the lira by pumping the dollar into the markets as well as by following some measures that relieve pressure on the Turkish lira. In general, the Turkish Central Bank reduces the price of the lira gradually and slowly, as a result of the stimulus policy pursued by the Central Bank, which is actually under the control of Turkish President Recep Tayyip Erdogan, which raises the interest rate. The Central Bank of Turkey received support amounting to 5 billion dollars from the Kingdom of Saudi Arabia in light of the economic cooperation between the two countries within the commitment of the Kingdom of Saudi Arabia to support Turkey's efforts to strengthen its economy.

TRY/USD Technical Analysis

On the technical front, the trading of the USD/TRY declined slightly during yesterday's trading, as the pair broke its all-time high, recording the 18.99 level. The pair maintained the general trend at the same time, and continued trading within the levels of the bullish channel on the time frame of the day, as well it is trading inside a smaller price channel on the four-hour timeframe.

With the pair's upward movement continuing at a slow pace, the USD/TRY is trading above the support levels of 18.80, 18.70, and 18.63, respectively. The pair is also trading below the resistance level at 18.99, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.50. The USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.