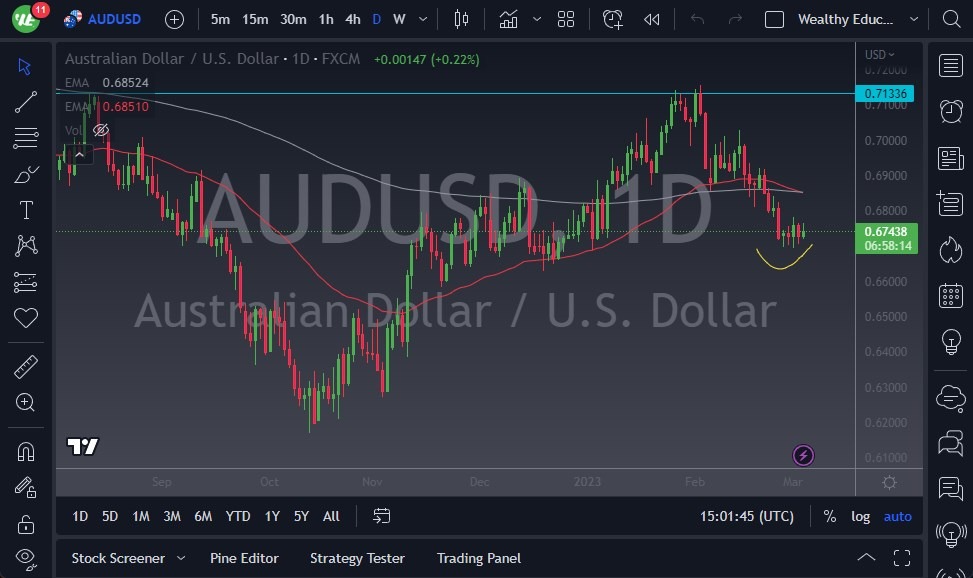

- The AUD/USD has seen a bit of a rally during Friday's trading session, as it has found support near the 0.67 level.

- Despite this, there is likely to be a lot of noise and sideways movement in this area, due to the importance of the 0.67 level in the past.

- As a result, short-term range-bound traders are likely to be making good profits, but swing and momentum traders may find themselves frustrated.

One thing to watch closely is the US dollar, as any movement in that currency could impact the direction of the AUD/USD pair. Additionally, risk appetite in general is likely to have a big impact on the Australian dollar, given its close ties to global growth. As long as there are issues out there, the Australian dollar is likely to remain somewhat soft.

If the AUD/USD pair were to break down below the 0.6650 level, it could signal a move down to the 0.6450 level, which would be a pro-US dollar move. On the other hand, if the pair were to rally, it could move up toward the 0.69 regions. However, the 50-Day EMA and 200-Day EMA in that area could provide some resistance.

Volatility is Likely to Continue

Given the uncertainty in the market right now, it's understandable that many traders are hesitant to take big positions in either direction. The overall volatility is likely to continue, and until there is more clarity on the direction of the market, it may be best to fade any rallies.

Ultimately, if the AUD/USD pair were to break above the 0.70 level, it would be a clearly bullish move. However, until that happens, traders are likely to continue seeing choppy and volatile price action. In the meantime, paying close attention to the US dollar and overall risk appetite could help provide some guidance on where the pair is headed.

It's worth noting that the Australian dollar has been impacted by several factors in recent months. The ongoing trade tensions between the US and China, two of Australia's major trading partners, have weighed heavily on the currency. Additionally, concerns about a slowing global economy and the potential for a recession have also had an impact. Because of this, I think that the Aussie will more likely than not going to continue to be a short-term but slightly negative asset, but regardless of your need to keep your position size reasonable and she could get hurt rather quickly if you are not careful.

Ready to trade our Forex daily forecast? We’ve shortlisted the largest forex brokers in Australia in the industry for you.