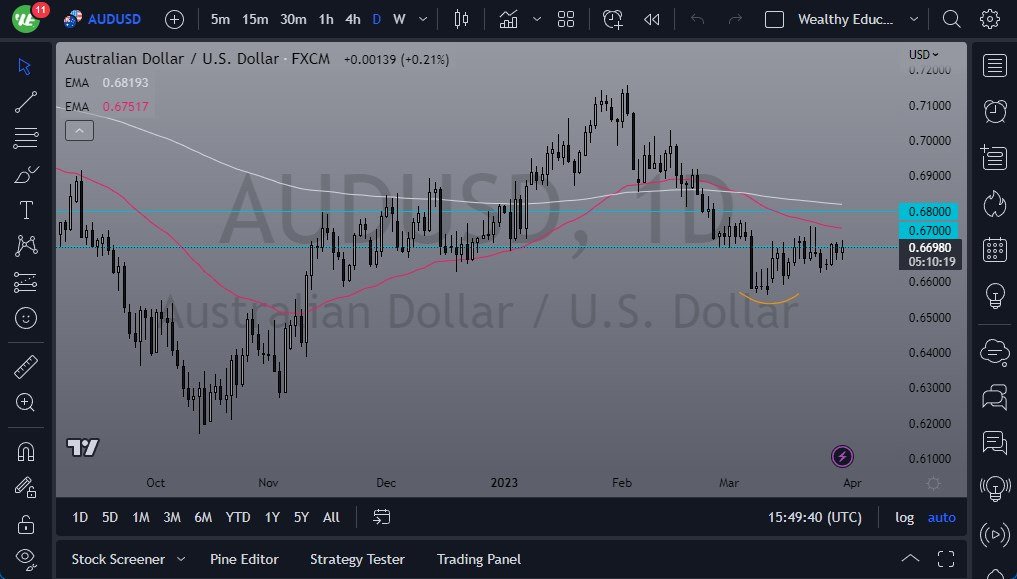

- The Australian dollar (AUD) has been subject to a lot of noisy trading recently, with the market going back and forth during Thursday's trading session.

- The 0.67 level has acted as both support and resistance several times in the past, and it is unlikely to change anytime soon.

- Additionally, there is significant resistance above the 0.67 level that extends to the 0.68 level, with a 50-day EMA slicing through the middle of it.

Decline In Sight

There have already been a couple of shooting stars attempting to pierce that resistance level last week, suggesting that there is a lot of trouble above. While it is not impossible to break above that level, it will be a challenging task. Many traders are still selling the US dollar on the hope that the Federal Reserve will come and bail everybody out, but the Federal Reserve continues to raise interest rates and has shown no proclivity to stop doing so.

However, the Australian dollar has been underperforming compared to other currencies against the US dollar, making it vulnerable to a stronger US dollar. If the US dollar picks up strength around the world, this pair is likely to fall harder than many others. In the longer term, if the market breaks down below the 0.66 level, it is very likely that it will continue to fall, potentially reaching down to the 0.63 level.

The Federal Reserve's monetary policy and the global economic situation will continue to influence the AUD/USD exchange rate. While there are hopes that the Federal Reserve will loosen monetary policy soon, they continue to raise interest rates. The Australian dollar's performance against the US dollar is also something to watch closely, as any strength in the US dollar could lead to a significant decline in this pair.

The AUD/USD exchange rate has been subject to noisy trading, with the 0.67 level acting as both support and resistance. There is significant resistance above this level, and it will be a challenging task to break through it. The Australian dollar's underperformance against other currencies against the US dollar makes it vulnerable to a stronger US dollar. If the market breaks down below the 0.66 level, it is likely to continue falling, potentially reaching the 0.63 level. The Federal Reserve's monetary policy and the global economic situation will continue to impact the AUD/USD exchange rate, making it an essential pair to watch for traders.

Ready to trade our daily Forex forecast? Here’s a list of some of the best forex trading platform for beginners Australia to check out.