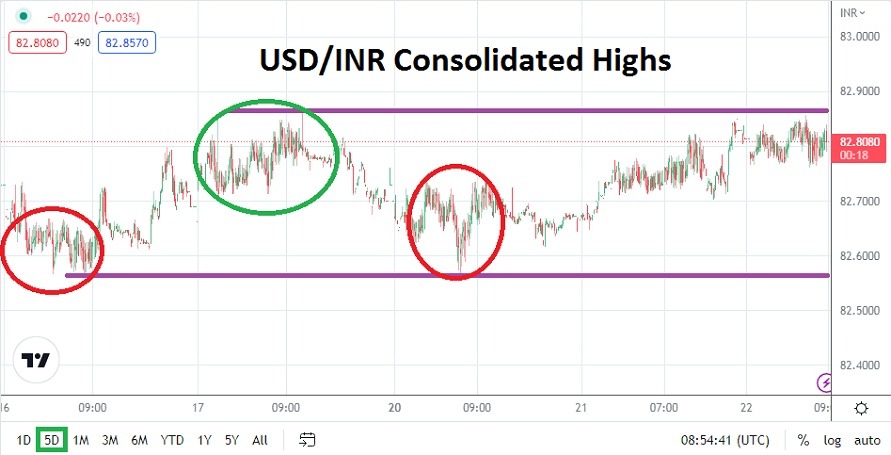

As the USD/INR trades within the upper vicinity of its price range and challenges the 82.8300 level as of this writing, speculators need to practice patience and solid risk-taking tactics. With all-time apex highs clearly within sight above the 83.0000 ratios, USD/INR traders cannot be faulted for being nervous.

Tomorrow’s U.S Preliminary Gross Domestic Product statistics are sure to be an ignition switch too. Consolidated conditions which have languished since early February will get a strong test tomorrow. Traders who are thinking about positioning their orders before the growth numbers are released from the U.S tomorrow will be simply wagering. Stop loss orders will be needed, but the understanding that the USD/INR will become fast and choppy needs to be understood.

On the 7th of February, the USD/INR essentially touched the 82.8600 realms. This occurred after the USD/INR was trading near the 81.6500 level on the 1st of February. Before traders simply say the USD/INR has been correlating to the broad Forex market, it should be remembered many major Forex pairs saw their trends reverse early in February when U.S Federal Reserve rhetoric was more aggressive than anticipated, and last week’s inflation reports showed prices in the States remain stubbornly high.

USD/INR One Month Trend Higher

However, the USD/INR intriguingly touched a low on the 23rd of January, when it touched the 80.8380 mark. Meaning the USD/INR has been within the grips of a bullish run for one month, at its climb higher started about a week and a half before other currency pairs. This highlights that it is not only U.S. data that is affecting the USD/INR, and other forces are active.

The consolidation within the USD/INR that has occurred in the past couple of weeks has certainly seen reversals higher and lower, but the currency pair has managed a rather tight trading range. This grip on values between 82.4000 and 82.9000 with some outliers since the 3rd of February will likely vanish tomorrow and traders need to be ready. The results from the U.S Preliminary GDP figures will stir conditions in the USD/INR.

Resistance near 82.8900 in the USD/INR should be monitored

- While the target of 83.0000 may be the obvious choice for experts talking about higher values in the USD/INR, the short-term support ratio of 82.8900 should be watched and used as a more conservative goal by bullish traders looking for quick-hitting wagers.

- Stop loss orders should be used wisely today and tomorrow. Volatility will begin to flourish before the U.S. growth numbers are released and afterward for a handful of hours.

If the GDP numbers from the U.S. are stronger than expected, this could ignite additional buying in the USD/INR, particularly by financial institutions that have been conservative the past week and wanted more evidence the U.S. Fed would remain aggressive. However, if the GDP data from the U.S. proves weaker than expected, this could spur on the selling of the USD/INR which tests support ratios between 82.6000 and 82.4000 in the near term rather quickly.

USD/INR Short-Term Outlook:

Current Resistance: 82.8810

Current Support: 82.7740

High Target: 83.0250

Low Target: 82.6900

Ready to trade our monthly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.