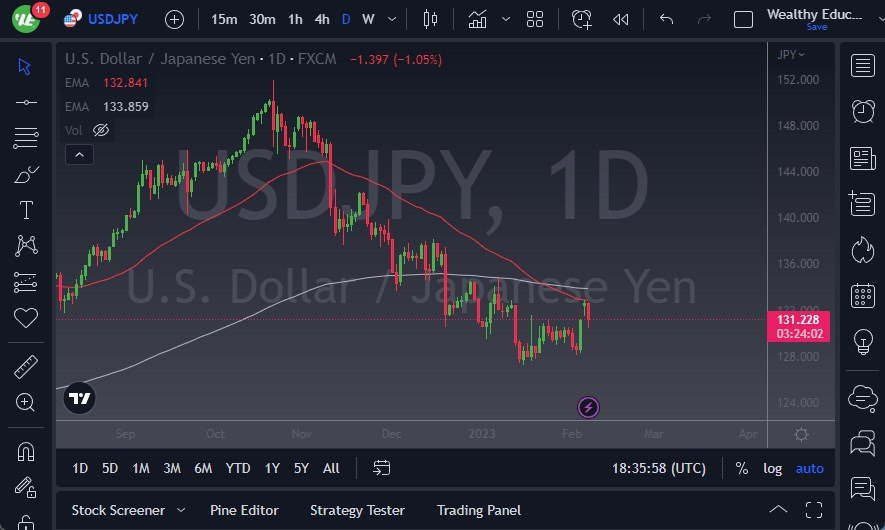

- The USD/JPY currency pair has pulled back during the trading session on Tuesday, to fill the price gap that we had put in the market at the open on Monday.

- Ultimately, this is a market that looks as if it is trying to go higher, but we also have to worry about whether or not the Bank of Japan is going to have to continue to try to manipulate the bond market.

- If the market were to see interest rates attack the 50 basis point level again in the 10 year JGB, then the Bank of Japan will have to print more yen, thereby driving the price of yen related markets higher.

Will the USD/JPY Pair Rejoin Last Year's Massive Uptrend?

The 50-Day EMA sits just above, and therefore it can cause a certain amount of trouble. After that, we have the 200-Day EMA, and therefore you need to pay close attention that one as well. If we break through both of those, then it’s likely that we go much higher, perhaps trying to reach towards the ¥137.50 level where we had seen a lot of selling pressure previously. Breaking above that unleashes quite a bit more upward momentum, turning the entire market around and rejoining the massive uptrend that we had seen during the previous year.

If we turn around and break down below the bottom of the candlestick, then we could go looking towards the bottom of the candlestick on Monday, which opens up the possibility of a move down to roughly ¥128.50. Anything below there then opens up an attack on the ¥127 level underneath that level, which is where I think the bottom opens up, and we open up a massive air pocket. As things stand right now, I do think that we are in the midst of trying to bottom, and therefore I do like the idea of buying short-term pullbacks that give us an opportunity to pick a “cheap dollars.” After all, the Federal Reserve is nowhere near loosening its monetary policy, and therefore think you’ve got a situation where we will continue to see the US dollar attract a certain amount of inflow, especially as it looks like the global economy might be getting ready to slow down and therefore people will be looking to pick up greenbacks anyway. With this, I think we have a real shot at this market trying to turn around.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.